BlackRock spot Bitcoin ETF sees promising pre-market trading activity

Quick Take

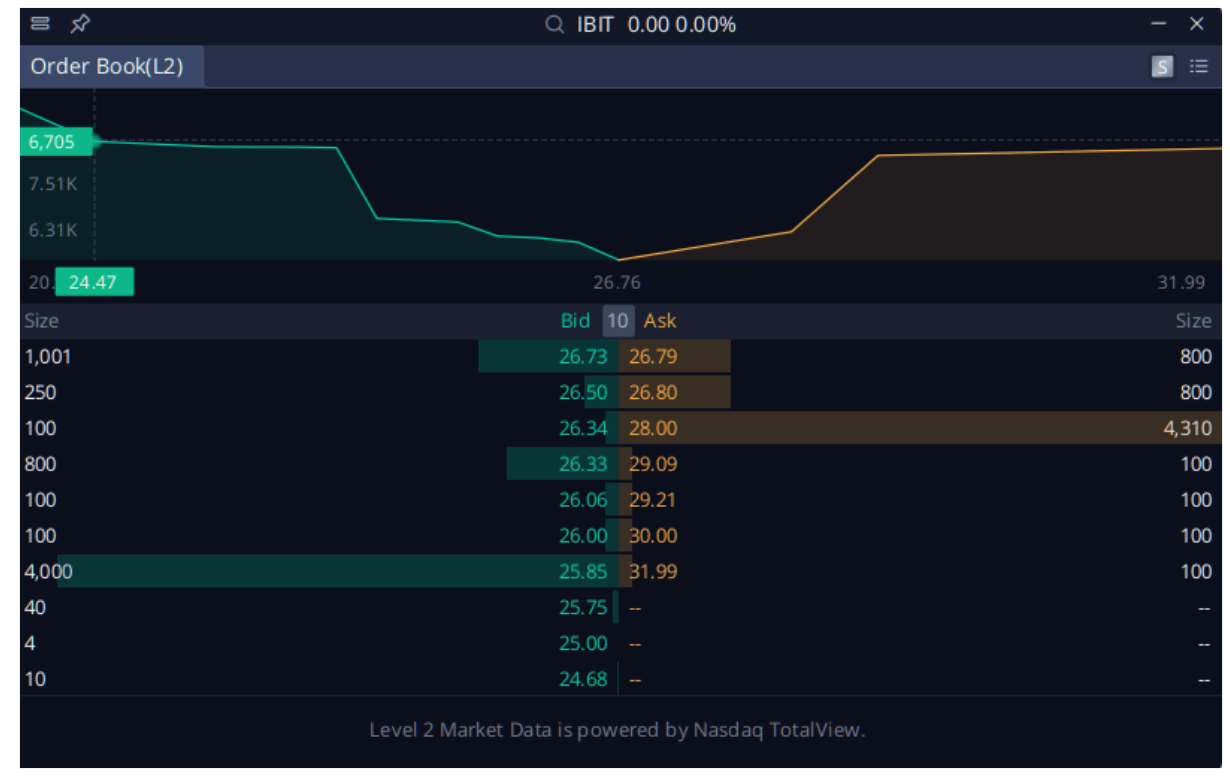

The pre-market trading landscape reveals a promising start for IBIT, BlackRock spot Bitcoin ETF. With pre-market trading in full swing on WeBull, volume has surged to 41,000, indicating increased investor activity.

Notably, the order book predominates bids over asks, indicative of a tilt towards buying rather than selling. BlackRock has 400k shares outstanding, so they’ve done almost 10% in volume before the market opened.

Bitcoin mining stocks demonstrate a similar upward momentum pre-market, underlining an augmented demand. Notable mentions include TeraWulf, with a 9% increase, and IREN and Marathon Digital Holdings, recording a 4% escalation. This coordinated rise in Bitcoin and associated stocks may highlight a broader trend of growing investor confidence in the digital currency sector.

Update:

Bloomberg ETF analyst Eric Balchunas has highlighted noteworthy trading activity around IBIT, with $2 million worth of shares already exchanged. Such high volume is atypical for a new ETF, especially in the early trading hours.

Such an event would make for a considerable first full trading day for most ETFs, an achievement amplified due to the timing, according to Balchunas.

However, the surge in trading volume is likely driven by BlackRock’s strategic plans. As it appears, BlackRock has been gradually loading in the “Build Your Own Allocation” (BYOA) funds that were prepared in advance, according to Balchunas.