BlackRock records $158 million inflows across Bitcoin and Ethereum ETFs

On Sept. 24, Bitcoin ETFs recorded a substantial inflow, totaling $136 million, driven primarily by BlackRock’s IBIT ETF, which saw an inflow of $98.9 million, marking the most significant movement of the day. Bitwise’s BITB ETF added $17.4 million, while Fidelity’s FBTC contributed $16.8 million. Grayscale’s smaller BTC ETF reported a modest inflow of $2.9 million, with GBTC flat. Other ETFs, including those from Ark, Invesco, Franklin, Valkyrie, VanEck, and WisdomTree, showed no activity, maintaining flat flows.

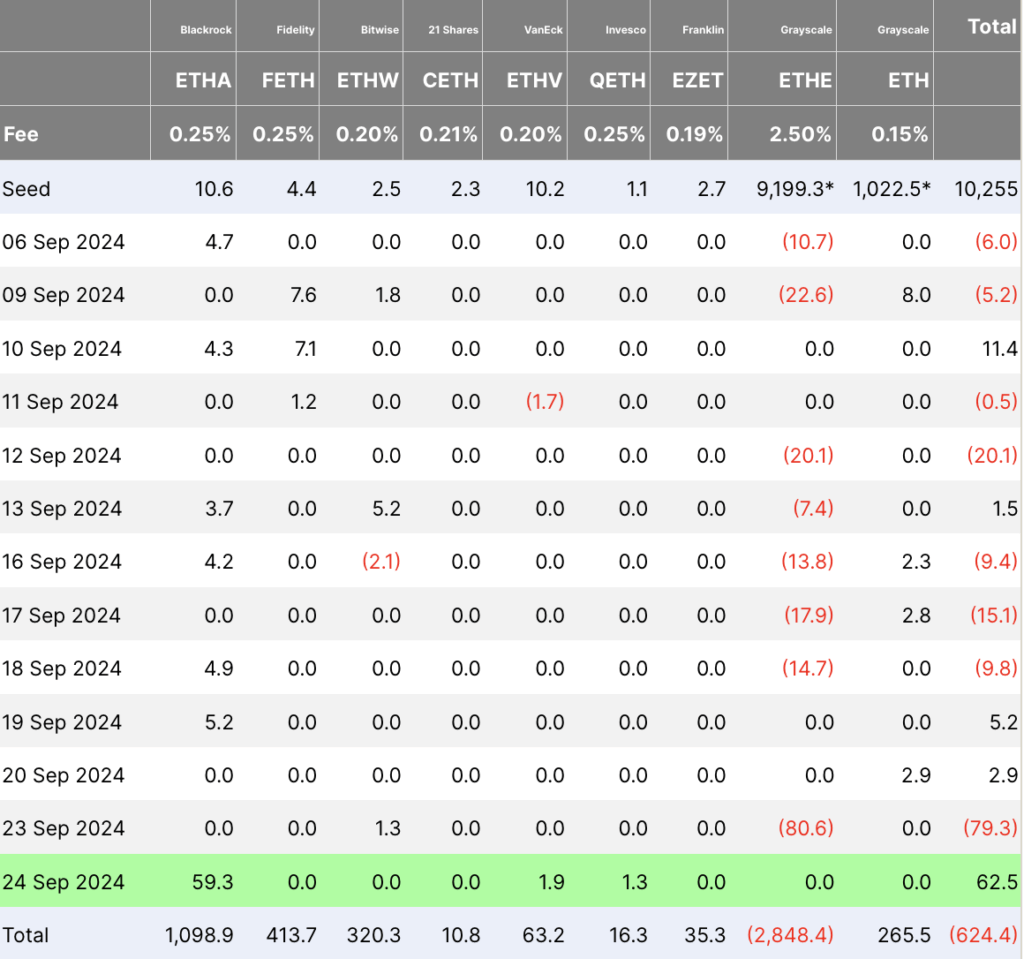

Ethereum ETFs experienced notable inflows, totaling $62.5 million. BlackRock’s ETHA ETF led the inflows with $59.3 million, suggesting a renewed interest in Ethereum exposure from institutional investors. VanEck’s ETHV and Invesco’s QETH ETFs also saw smaller inflows of $1.9 million and $1.3 million, respectively. All other Ethereum ETFs reported no flow changes, including those from Fidelity, Bitwise, 21Shares, Franklin, and both of Grayscale’s funds.

The significant inflows into Bitcoin ETFs, especially from BlackRock, contrast with the more measured but positive inflows into Ethereum ETFs, indicating a broad-based accumulation trend with stronger momentum toward Bitcoin products.