BlackRock IBIT ETF nears $15 billion net milestone amid $308 million inflow

Quick Take

Farside data revealed a $203.0 million net inflow on Apr. 5, marking the Bitcoin ETFs’ fourth consecutive net inflow day. This trend suggests a growing interest and confidence in the digital asset space among investors. Notable among the ETF providers is BlackRock’s IBIT, which saw a substantial net inflow of $308.8 million, bringing its cumulative total net inflow to $14.7 billion. This represents the biggest net inflow day for IBIT since March 27, underscoring the fund’s growing prominence in the market.

Meanwhile, Fidelity’s FBTC also experienced a healthy $83.0 million net inflow, contributing to its total net inflow of $7.9 billion. In contrast, Grayscale’s GBTC witnessed significant outflows of $198.9 million, the largest since Apr. 1, bringing its total outflow to $15.5 billion, according to Farside.

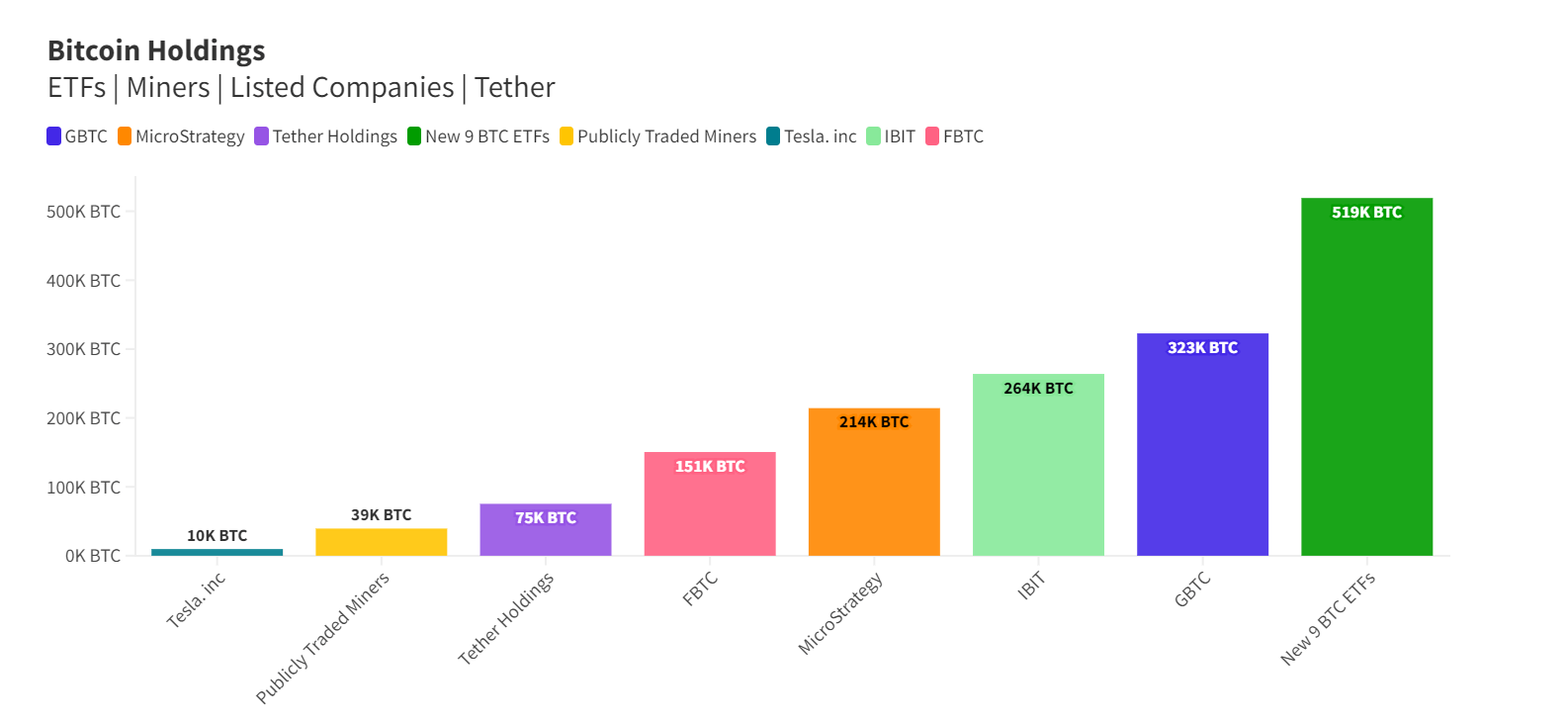

The data from Heyappolo reveals that GBTC currently holds 323,000 Bitcoin, while IBIT has accumulated 264,000 Bitcoin, and FBTC holds 151,000 Bitcoin. Interestingly, the new 9 BTC ETFs, excluding GBTC, have collectively amassed 519,000 Bitcoin.

Farside Investors

Farside Investors