BlackRock continued inflows narrow gap: just 37,781 BTC separate IBIT from GBTC

Quick Take

Farside data indicates that Bitcoin (BTC) Exchange-Traded Funds (ETFs) experienced an outflow of $36.7 million on April 15. Notably, Grayscale GBTC recorded an outflow of $110.1 million, contributing to their total net outflow reaching $16.3 billion. Conversely, BlackRock IBIT attracted $73.4 million in inflows, bolstering its net inflow to $15.3 billion. Fidelity recorded two straight days of zero net flows after breaking its inflow streak.

Despite this recent outflow, the overall net inflows across all ETFs remained robust, totaling $12.4 billion, according to Farside data.

Farside data shows that a similar scenario unfolded on April 12, mirroring April 15’s trends. Once more, IBIT stood as the sole ETF with inflows, recording $111.1 million, while GBTC experienced outflows of $166.2 million. This resulted in a net outflow of $55.1 million for the day.

The inflows into Bitcoin ETFs have slowed after a triumphant three-month run, with IBIT being the only ETF sustaining inflows for the past two trading days. Nevertheless, despite Bitcoin’s price decline of approximately 15% from its all-time high, the absence of significant outflows from other ETFs suggests investors are adopting a long-term perspective.

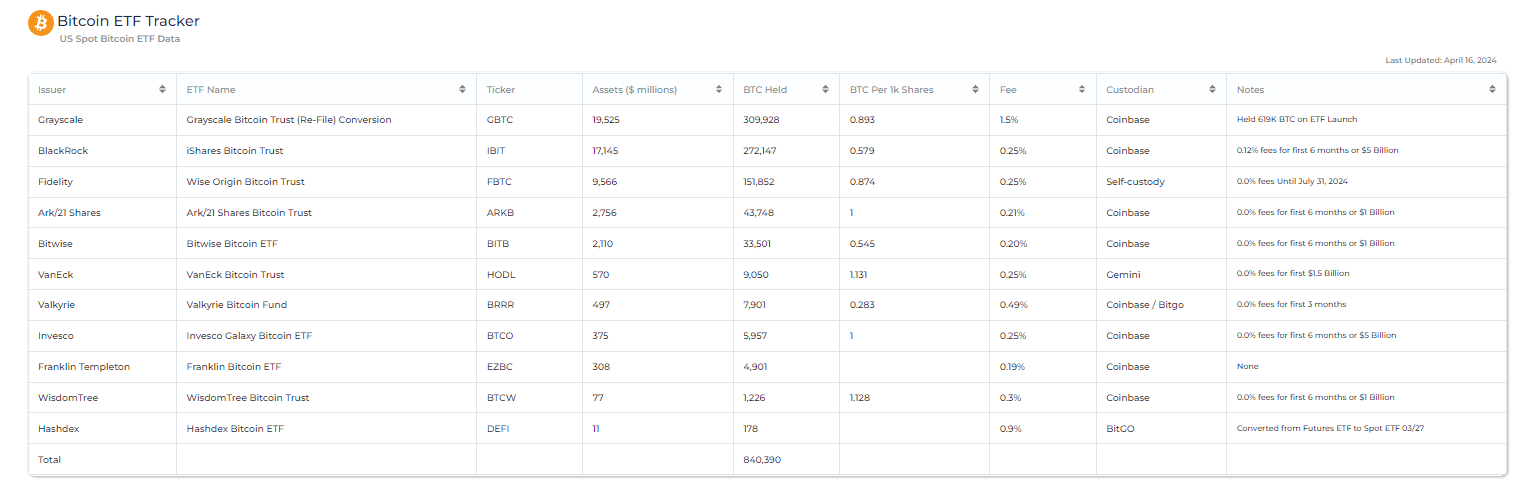

Based on Heyapollo data, GBTC currently holds 309,928 BTC, whereas IBIT holds 272,147 BTC, indicating a difference of 37,781 BTC between them.

Farside Investors

Farside Investors