Bitcoin’s whirlwind day sees $440M in market liquidations as CME overtakes Binance in open interest

Quick Take

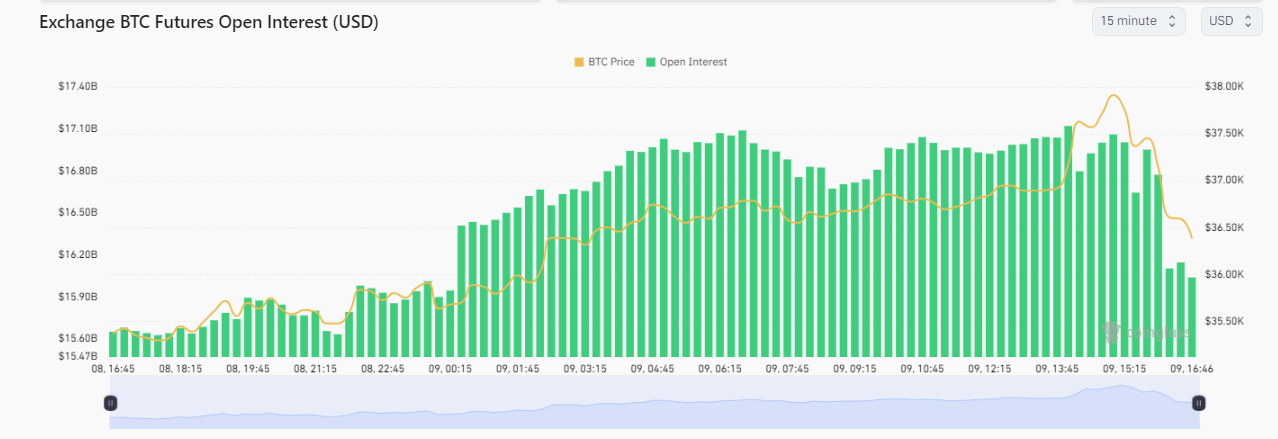

Bitcoin’s trajectory on Nov 9 presents a compelling case study in market volatility. Briefly touching $38,000, Bitcoin’s price has since dialed back to settle at $36,500. This short-lived surge drove Bitcoin’s market cap from an initial $715B to a zenith of $740B, before receding back to $715B.

The noteworthy aspect is the day-to-day market cap increase, where at the peak, Bitcoin’s market cap soared by approximately 4.5%, escalating from $697B to $729B. This stood at one of the most significant one-day percentage change increases in Bitcoin’s storied market cap history, just outside the top 10.

However, this surge was not without repercussions. Liquidations over the last 24 hours have surpassed $440M in the crypto market, a direct consequence of the abrupt market flush.

| Time | Liquidation Amount |

|---|---|

| 1 hour | $147M |

| 4 hours | $262M |

| 12 hours | $334M |

| 24 hours | $446M |

Source: Coinglass

Concurrently, open interest has seen a reduction by over 5%, effectively eradicating $1B of open interest in Bitcoin.

Significantly, this turbulence has resulted in a shifting landscape regarding exchange open interest. Chicago Mercantile Exchange (CME) has now ascended to become the largest exchange in this regard, following a substantial wipeout of open interest from Binance.