Bitcoin’s volatile year yields $90 billion in profits amidst $53 billion in losses

Quick Take

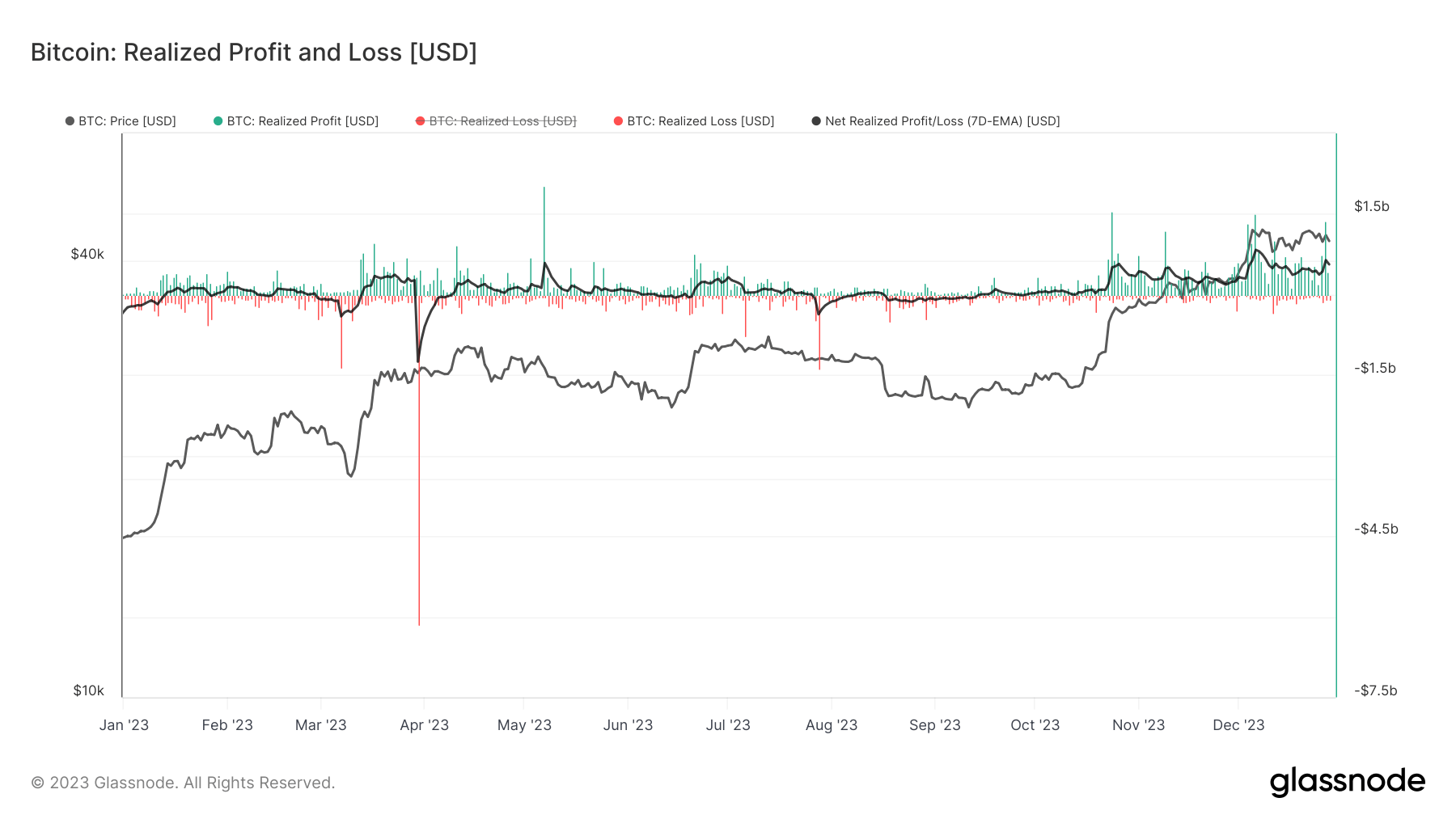

The fiscal landscape of 2023 for Bitcoin painted an intriguing picture. Although Bitcoin surged about 160% year-to-date, a deeper understanding of the realized profits and losses reveals a more nuanced scenario. The year witnessed Bitcoin’s realized profits reaching over $90 billion, whereas realized losses also made a significant mark at $53 billion.

Interestingly, a comparative analysis with the previous year shows a stark contrast. 2022 recorded approximately $200 billion in realized losses, outpacing the realized profit of only $106 billion—indicating a more significant profit in 2022 compared to 2023.

A closer examination of 2023’s financial events shows a few significant instances of realized losses. The two largest losses on a single day occurred just before the SVB collapse in March and again in July, each seeing $1.3 billion in losses. However, the March downturn was primarily due to wallet movement and does not conclusively indicate realized losses.

A noteworthy trend emerged from November onwards as Bitcoin’s price surged from $25,000 to $45,000. This period marked a regime of profit-taking, which appears to create potential short-term headwinds for Bitcoin.

Glassnode

Glassnode