Bitcoin’s Sharpe Ratio signals balanced risk-reward over five years

Quick Take

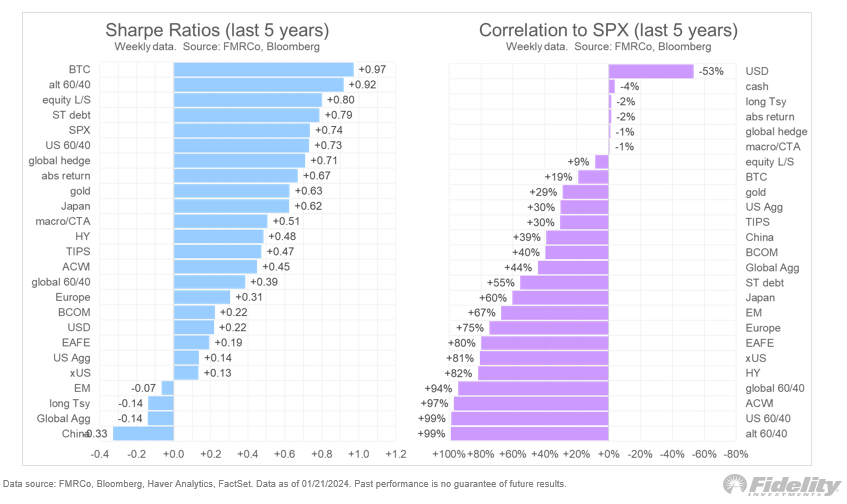

A Sharpe Ratio for Bitcoin (BTC) +0.97 over the past five years presents a noteworthy observation, according to Jurrien Timmer, director of Global Macro at Fidelity.

Despite the renowned volatility of Bitcoin, this ratio suggests that the digital asset has offered a close to even exchange between risk and excess return over the risk-free rate. This level of the Sharpe Ratio implies that the returns gained have been roughly in line with the risk assumed by investors despite the turbulent nature of digital asset markets.

This places Bitcoin towards the upper end compared to other investment categories, such as SPX (+0.74) or the US 60/40 portfolio (+0.73), hinting at a historically superior risk-adjusted performance.

In relation to the S&P 500 (SPX), Bitcoin exhibits a correlation of +19%. This translates to a reasonably weak association with the SPX, though not strong enough to be significant. This suggests that while Bitcoin does display some synchronized movement with the U.S. equity market, it still maintains a substantial level of independence in its price movements.