Bitcoin’s scarcity model hints at massive undervaluation

Quick Take

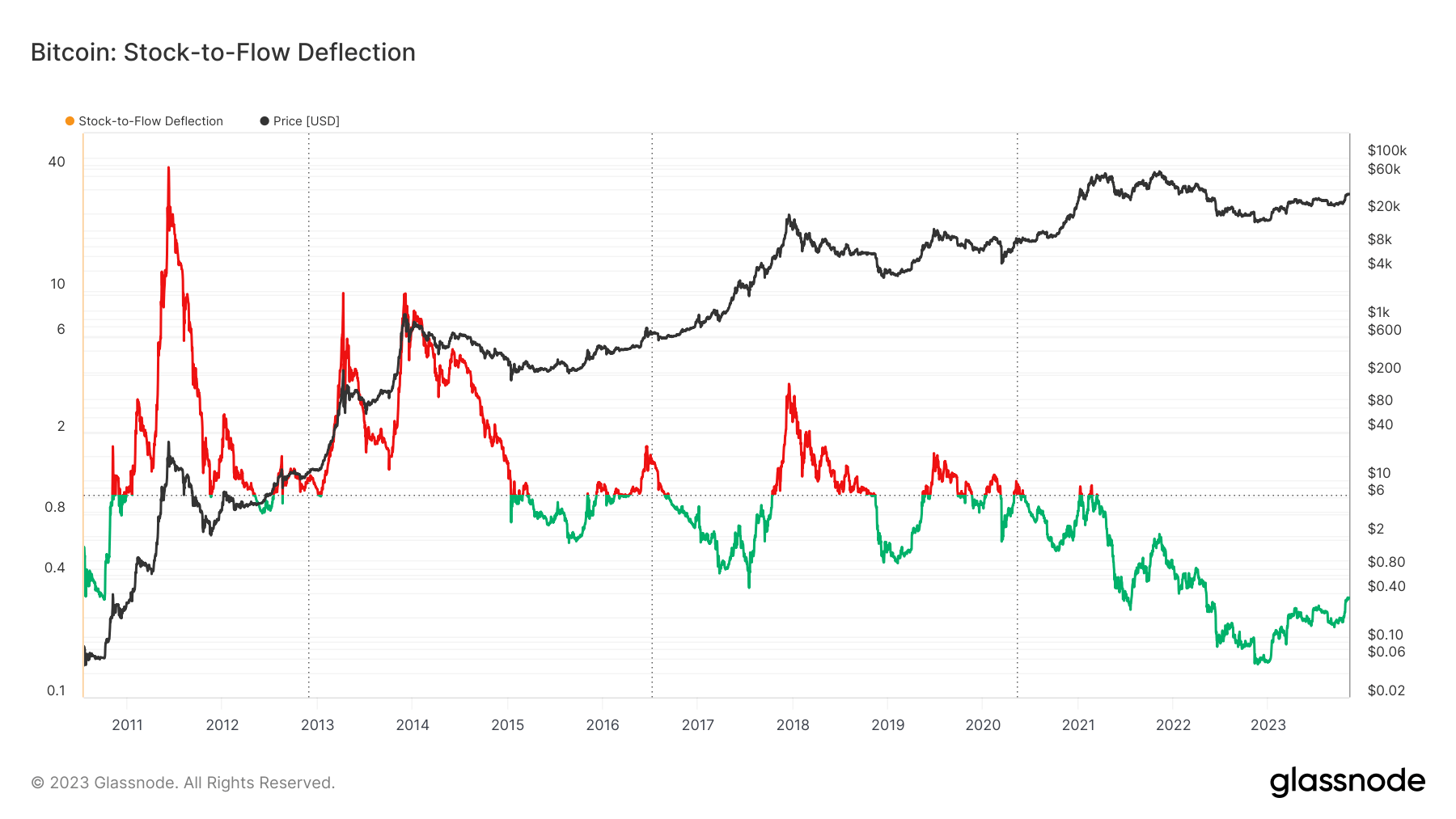

Bitcoin’s Stock-to-Flow (S/F) Ratio, a model built on the premise that scarcity fuels value, appears to be regaining its predictive force.

Historically, Bitcoin’s price has moved in tandem with the S/F ratio, making it a potentially useful tool for predicting future valuations.

However, the model deviated from predictions around April 2021, during the bull market run. Interestingly, with the halving five months away, Bitcoin’s trajectory seems to have realigned with the S/F ratio. Although still $65,000 short of the model’s prediction, the trend indicates a positive direction.

The S/F deflection, measuring the divergence between the current Bitcoin price and the S/F model, suggests Bitcoin is still significantly undervalued. This is based on the model’s assumption that a deflection greater than or equal to 1 indicates Bitcoin is overvalued and vice versa. Notably, the only time Bitcoin was deemed more undervalued according to this model was during the FTX collapse in 2022.

Glassnode

Glassnode