Bitcoin’s rally near $28,000 sparks $75 million in market liquidations

Quick Take

Bitcoin exhibited a price surge of more than 2.5% in the last 24 hours and an overall increase of 4% across the weekend, positioning it just under the noteworthy $28,000 mark.

This uptick in Bitcoin’s value has had a significant ripple effect on the broader crypto market, instigating a total of $75 million in liquidations in the past 24 hours. Of this amount, Bitcoin’s price surge alone prompted $30 million in short liquidations. An analysis of the liquidations reveals a predominance of short liquidations, accounting for $62 million, while long liquidations made up the remaining $13 million.

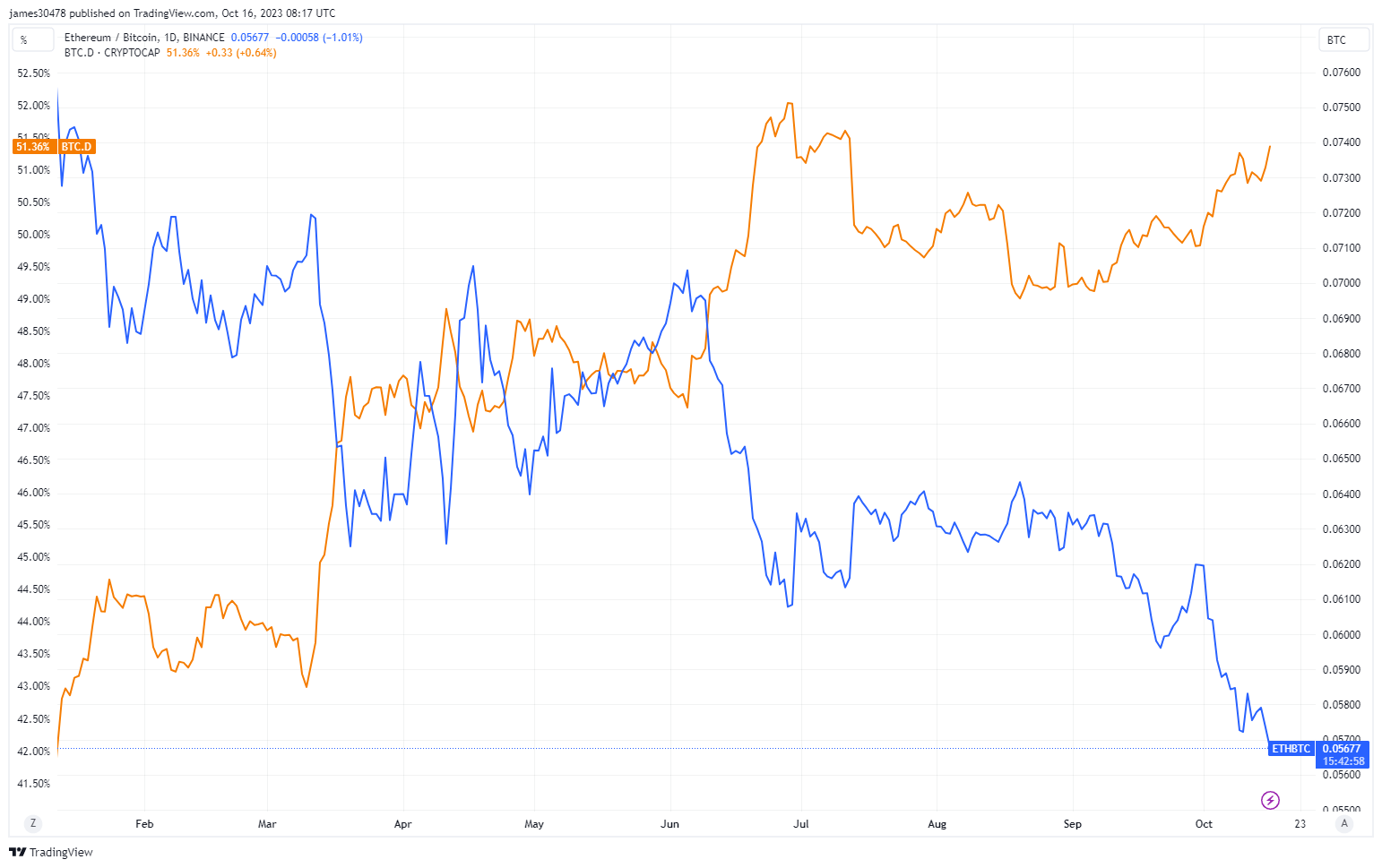

In addition, the Ethereum/Bitcoin ratio, a reliable indicator of Bitcoin’s performance, registered a new low, declining by 1% over the past 24 hours to the current price of 0.0567. This dip underscores Bitcoin’s prevailing strength. Concurrently, Bitcoin’s dominance ratio has surpassed 51.3%, positioning itself on the cusp of a new year-to-date high, which, if achieved, would exceed 52%.