Bitcoin’s price drop supported by 100x leverage

Quick Take

Open Interest and Liquidation Event

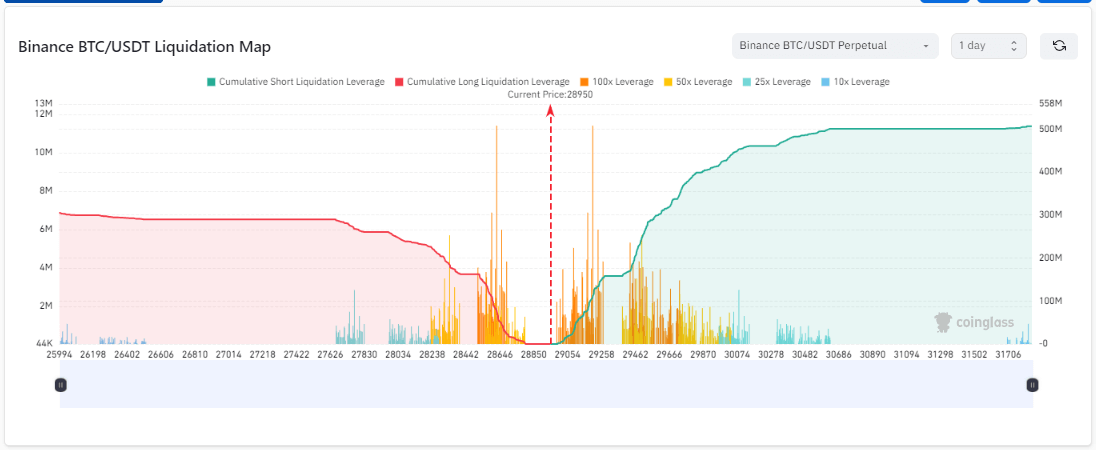

During the early hours of the morning on Aug. 1, open interest in Bitcoin increased on Binance, moving from 106,000 Bitcoin to 111,000 Bitcoin, a change of roughly $145 million. Subsequently, funding rates began to drop, triggering liquidations alongside.

Long Liquidations

The impact was felt significantly, with roughly $12 million in long liquidations occurring. This event represents the most substantial liquidation since July 24 and showcases the market’s volatility.

The $29,000 Price Level and Leverage

Around the $29,000 price mark, either above or below this level, there is a serious amount of leverage that could be liquidated, even up to 100x. If Bitcoin were to experience a further drop, it could lead to a more pronounced price decline, as leveraged positions would be liquidated. This scenario highlights the risky nature of highly leveraged positions and the possible cascading effect on Bitcoin’s price.