Insights

Bitcoin’s ongoing rally not derivatives or leverage driven

Quick Take

- Many discussions have been around whether the recent Bitcoin rally is spot or derivatives driven.

- With the recent insight yesterday showing considerable spot accumulation on Coinbase, we can confirm it is not being driven by derivatives — which is exceptionally healthy.

- The Estimated Leverage Ratio is the ratio of the open interest (OI) in futures contracts and the balance of the corresponding exchange.

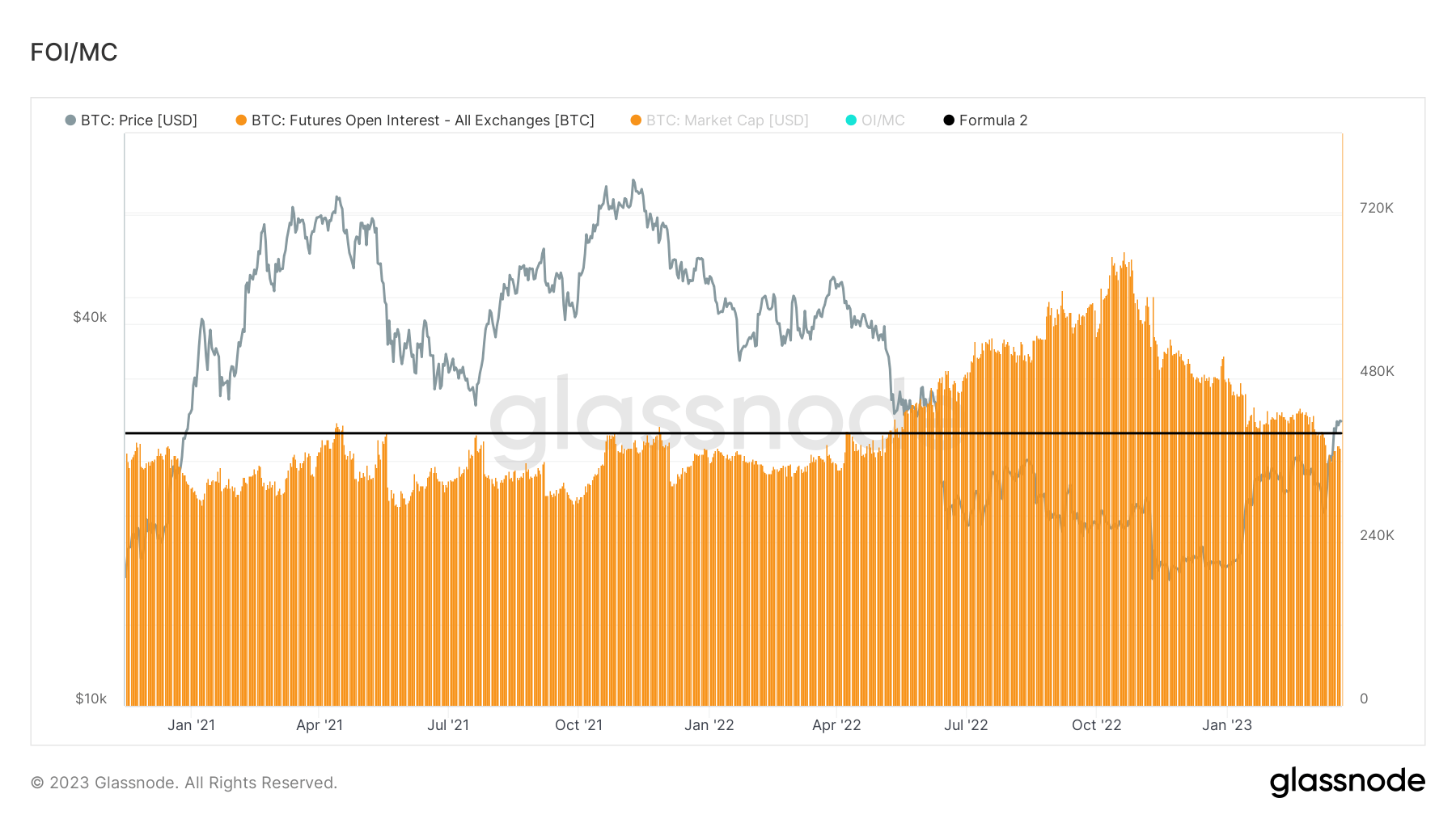

- We are yet to see a meaningful build-up of OI — while the leverage ratio across exchanges is below the average of the past three years.

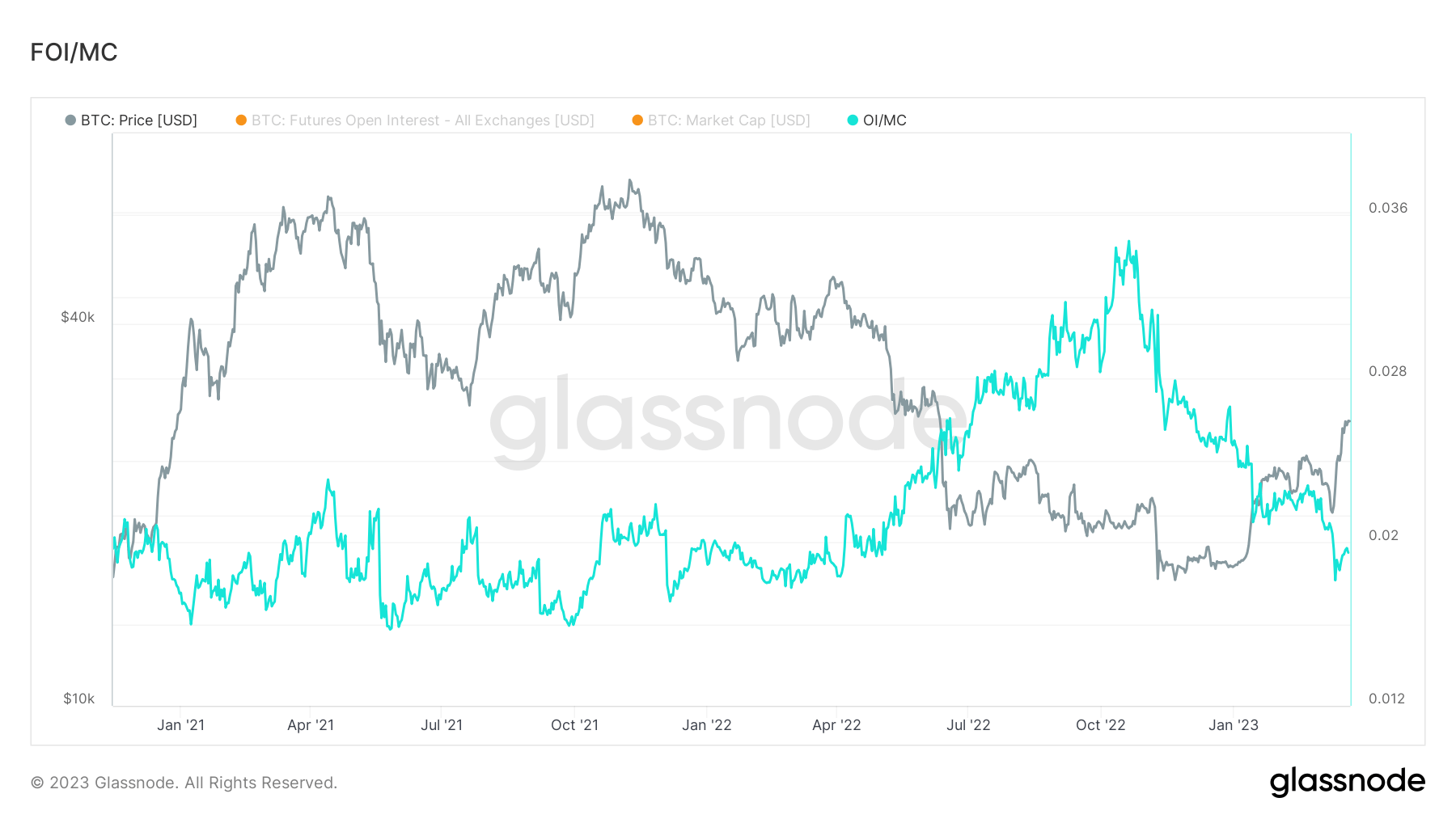

- OI is less than 400,000 Bitcoin below the three-year average — while OI is currently 2% the size of the Bitcoin market cap.