Bitcoin’s drop triggers $1.57 billion in liquidations

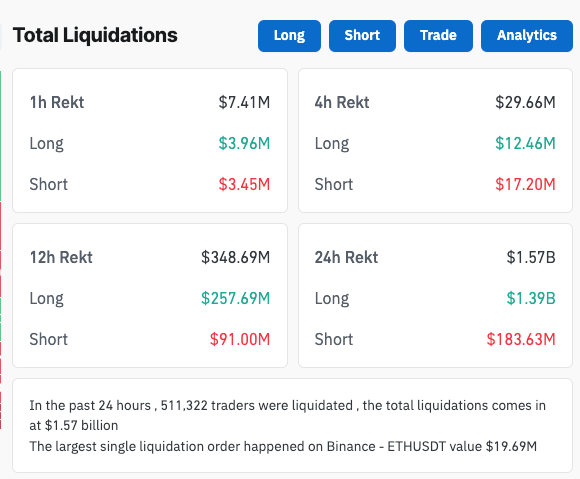

In the past 24 hours, the crypto market saw $1.57 billion in liquidations, the highest recorded since September 2021.

Bitcoin’s drop below $97,000 led to $1.39 billion in longs being liquidated and just $183.63 million in shorts. Such a high dominance of longs shows overconfidence among traders expecting Bitcoin’s price to rise past $100,000 in the coming days.

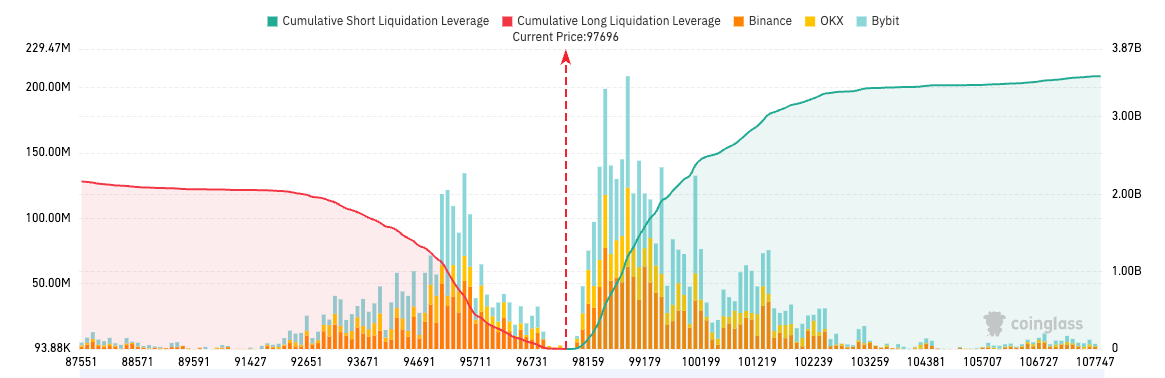

The liquidation heatmap from CoinGlass reveals concentrated liquidations around the $97,700 mark, which indicates that heavily leveraged positions were mainly clustered there.

The cumulative long liquidation curve also steepens dramatically around this level, showing that $97,700 was a critical support level for leveraged longs. Once breached, it caused cascading liquidations, further amplifying the downward price movement that pushed BTC below $97,000. Shorts were relatively minor compared, with their curve remaining flat, showing a lack of aggressive short positioning at higher prices.

The 12-hour liquidation data shows a substantial $91 million in short liquidations, which occurred earlier during Bitcoin’s price rise before the drop. This indicates that some traders attempted to short a rally, only to be liquidated as the price briefly surged before falling.

The steep drop in leveraged long positions at $97,000 suggests a potential short-term recovery as sell-side pressure weakens.