Bitcoin’s climb to a yearly high triggers market shakeup

Quick Take

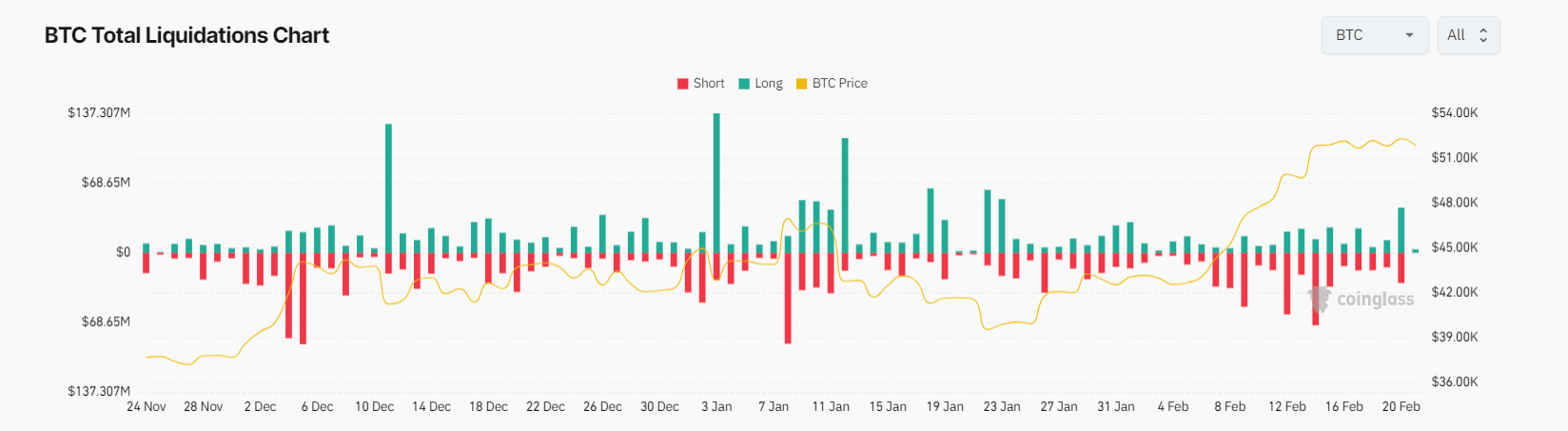

On Feb. 20, just before the US market opened, Bitcoin reached a yearly peak of $53,000, only to retreat into the $50k-$52k range shortly thereafter.

CryptoSlate reports indicate that approximately $1 billion worth of market liquidations were concentrated around Bitcoin’s $53,000 mark. Interestingly, during its short-lived surge to this value, Bitcoin experienced an estimated $70 million worth of these liquidations. While some of these liquidations happened during the rise, the majority are still impending.

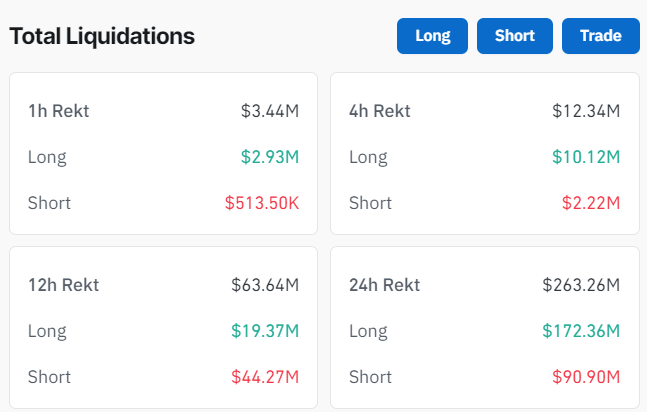

In the broader digital asset market, Coinglass reported that the past 24 hours have seen an estimated $260 million in liquidations, with approximately $170 million from longs and $90 million from shorts. Bitcoin bore the brunt of these liquidations, accounting for around $70 million. While, Binance saw the majority of the liquidations from an exchange at approximately $117 million.

Out of Bitcoin’s $70 million liquidation, approximately $40 million was derived from long positions. This accounts for the largest long liquidation since Jan. 23, when Bitcoin was trading around the $40,000 mark.

CoinGlass

CoinGlass