Bitcoin’s buying power bolstered by stablecoin market movements

Quick Take

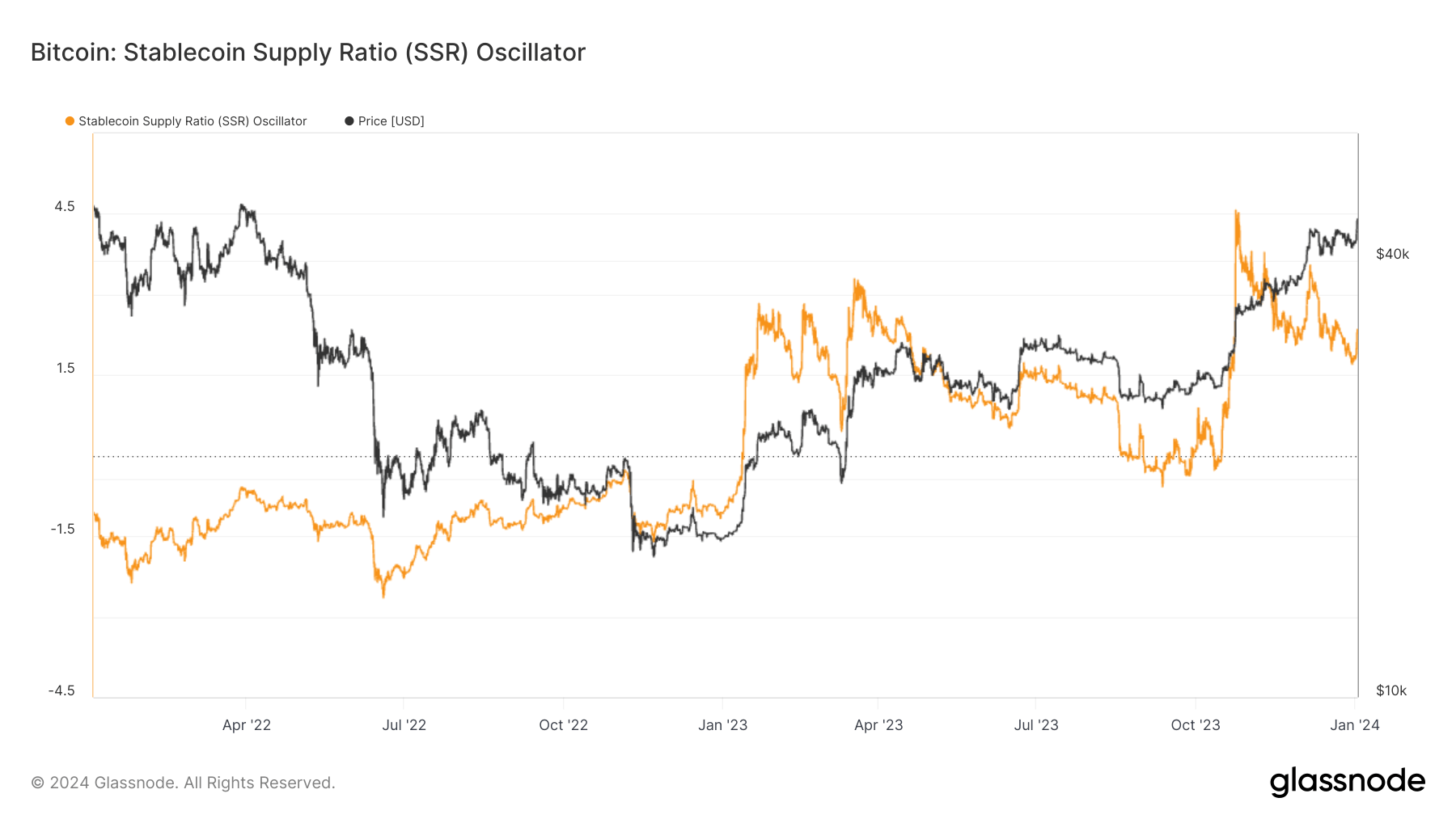

Observations since October 2023 indicate a consistent upward trend in the Stablecoin Supply Ratio (SSR), closely tracking the upper bound of the ratio. This measure, which represents the relationship between the supply of Bitcoin and that of stablecoins denominated in Bitcoin, acts as an indicator of the supply-demand dynamics between Bitcoin and the US dollar. The SSR’s upward trajectory suggests an increasing “buying power” of the present stablecoin supply for Bitcoin.

The Stablecoin Oscillator, derived from the SSR, quantifies the movement of the SSR’s 200-day simple moving average (SMA) within the Bollinger Bands. It reached a high of 2.36 in January 2024, mirroring the upward trend seen in October and December 2023 and signaling a substantial inflow of stablecoins into Bitcoin.

This rising trend of the SSR, along with the notable movement detected by the Stablecoin Oscillator, provides deeper insight into the factors behind the recurring Bitcoin price surges.

Glassnode

Glassnode