Bitcoin’s 2024 hodler net position change mirrors historical cycles, signals potential price stabilization

Onchain Highlights

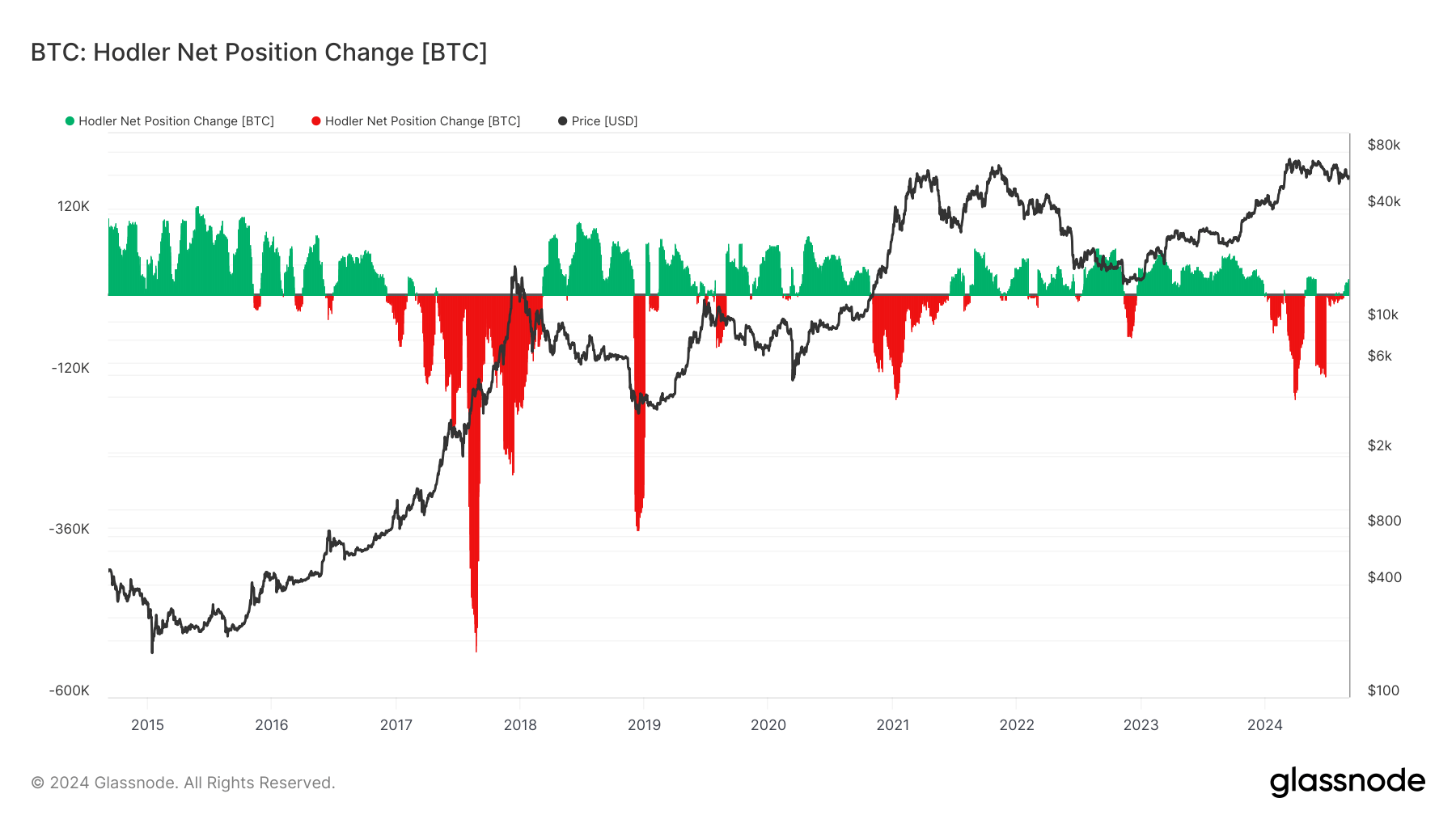

DEFINITION:Hodler Net Position Change shows the monthly position change of long term investors (HODLers). It indicates when HODLers cash out (negative) and when net new positions are accumulated by HODLers.

Bitcoin’s hodler net position change historically aligns with key market cycles, reflecting long-term investor sentiment during price fluctuations. In 2024, significant shifts in hodler behavior were observed, particularly around the April halving. From February to April, hodlers reduced their positions substantially, coinciding with Bitcoin’s sharp price drop from over 760,000 to around $50,000. However, positions were not reduced as heavily during the August sell-off. This pattern mirrors previous cycles, such as the 2018 bear market, where negative hodler net position changes were seen as prices declined.

Post-halving, in May and August, holders began accumulating Bitcoin once more, echoing behavior observed after previous halvings in 2016 and 2020. The accumulation phase that started in mid-May 2024 corresponds with a recovery in Bitcoin’s price, which has risen back towards $60,000. This trend is consistent with the 2019 market, where hodler accumulation preceded a significant price increase.

Overall, the 2024 data reinforces the cyclical nature of Bitcoin markets, where hodlers strategically adjust their positions in response to price trends and broader market conditions. This pattern suggests that the recent accumulation phase could precede a new period of price stability or growth.

Glassnode

Glassnode