Bitcoin surges to $97k as market leverage hits historic $63 billion

Bitcoin’s relentless rally has taken the leading digital asset to new heights, surpassing $97,000 to reach a new all-time high of $97,862.

This surge, ignited by a broader wave of optimism following Donald Trump’s recent political victory, has positioned Bitcoin just inches from the highly anticipated $100,000 mark. Reaching this milestone would be pivotal for the top asset, further cementing its status in the broader financial industry and pushing its market capitalization beyond the $2 trillion mark.

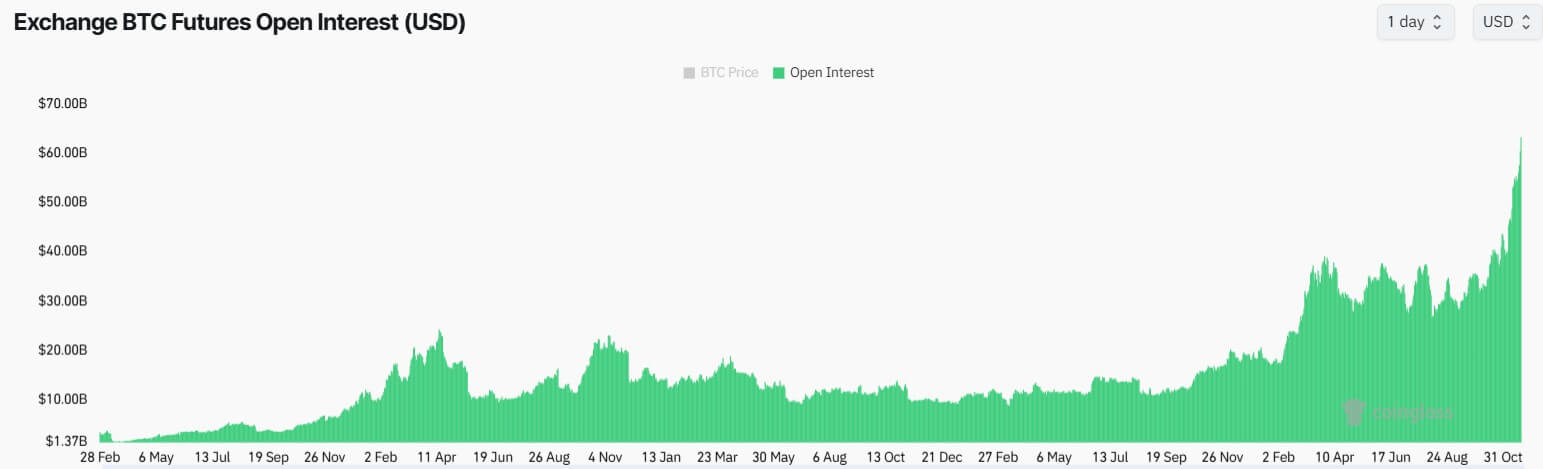

The derivatives market is playing a central role in this bull run. According to Coinglass data, Bitcoin’s Open Interest has climbed to $63 billion, a historic high that marks a 147% increase in market leverage compared to its 2021 peak of more than $20 billion. At that time, Bitcoin’s price hit an all-time high of around $69,000.

However, the current market trends present risks. The growing leverage in derivatives amplifies volatility, making the market more susceptible to sharp price swings.

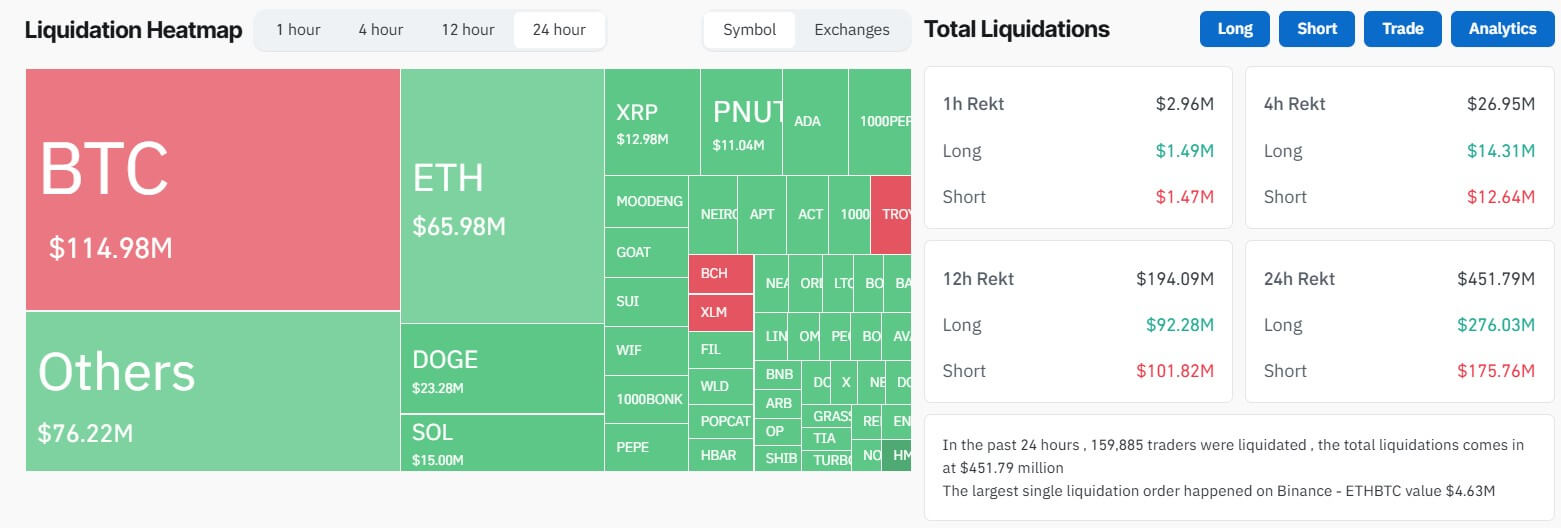

Already, Bitcoin’s price fluctuations have triggered industry-wide liquidations exceeding $450 million over the past 24 hours. Of these, 60% came from short positions, indicating significant losses for traders betting against the rally.

As Bitcoin edges closer to the six-figure milestone, market participants should remain cautious amidst heightened volatility.

CoinGlass

CoinGlass