Bitcoin supply dynamics shift as long-term holders sell while dolphins buy

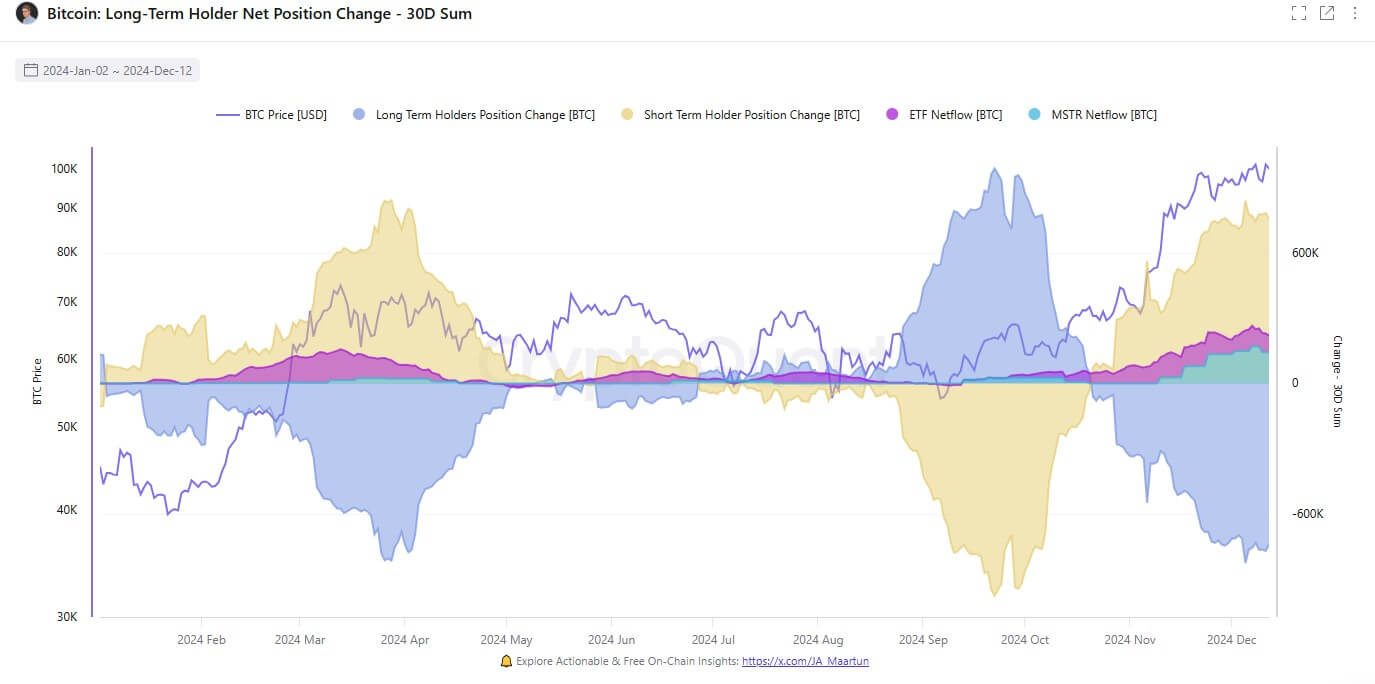

On-chain data reveals growing selling activity among long-term Bitcoin holders, whose collective holdings have hit their lowest levels this year.

Prominent crypto analyst James Check, also known as Checkmate, emphasized the scale of this trend, noting that the selling pressure from these holders far outweighs the demand from ETFs and institutional players like MicroStrategy.

Data from CryptoQuant shows that long-term holders (LTHs) — investors who retain Bitcoin for over 155 days — have offloaded around 800,000 BTC over the past month.

Meanwhile, institutional entities such as MicroStrategy added 149,880 BTC, and Bitcoin ETFs acquired 84,193 BTC. This still left 487,000 BTC to be absorbed by short-term holders, primarily retail investors.

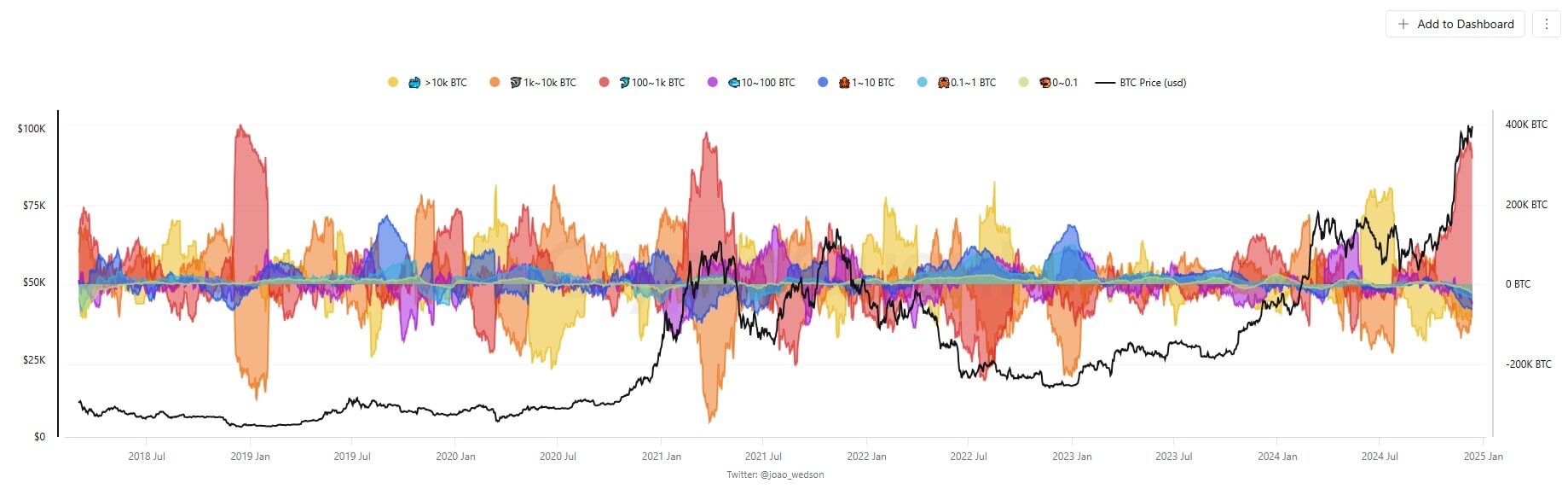

Interestingly, dolphins — wallets holding between 100 and 500 BTC — have emerged as significant buyers during this period, accumulating over 350,000 BTC. This shift highlights a notable change in supply trends and market sentiment.

While institutional and ETF-driven demand has not immediately translated into sharp price movements, it signals evolving participant profiles and their growing influence on Bitcoin’s market trends.

CryptoQuant

CryptoQuant