Bitcoin shatters ‘digital gold’ narrative with new independent trading pattern

Quick Take

In a striking shift from established patterns, Bitcoin’s correlation with both Ethereum and Gold has significantly decreased in the past 90 days.

Historically, Bitcoin has, at times, mirrored the performance of major assets like US equities, trading one-to-one in the post-Covid era. Its similar trading correlation to gold after the March banking crisis even led to further narratives of Bitcoin being ‘digital gold.’

However, recent data reveals a contrasting scenario. While US equities have been on an upward trajectory, Bitcoin’s price movement has remained relatively static.

In a 90-day snapshot, Bitcoin’s correlation with gold is at -0.53, marking the second-lowest correlation in recent years. The only other time such a low correlation was observed was during the FTX collapse, which temporarily suppressed Bitcoin’s price.

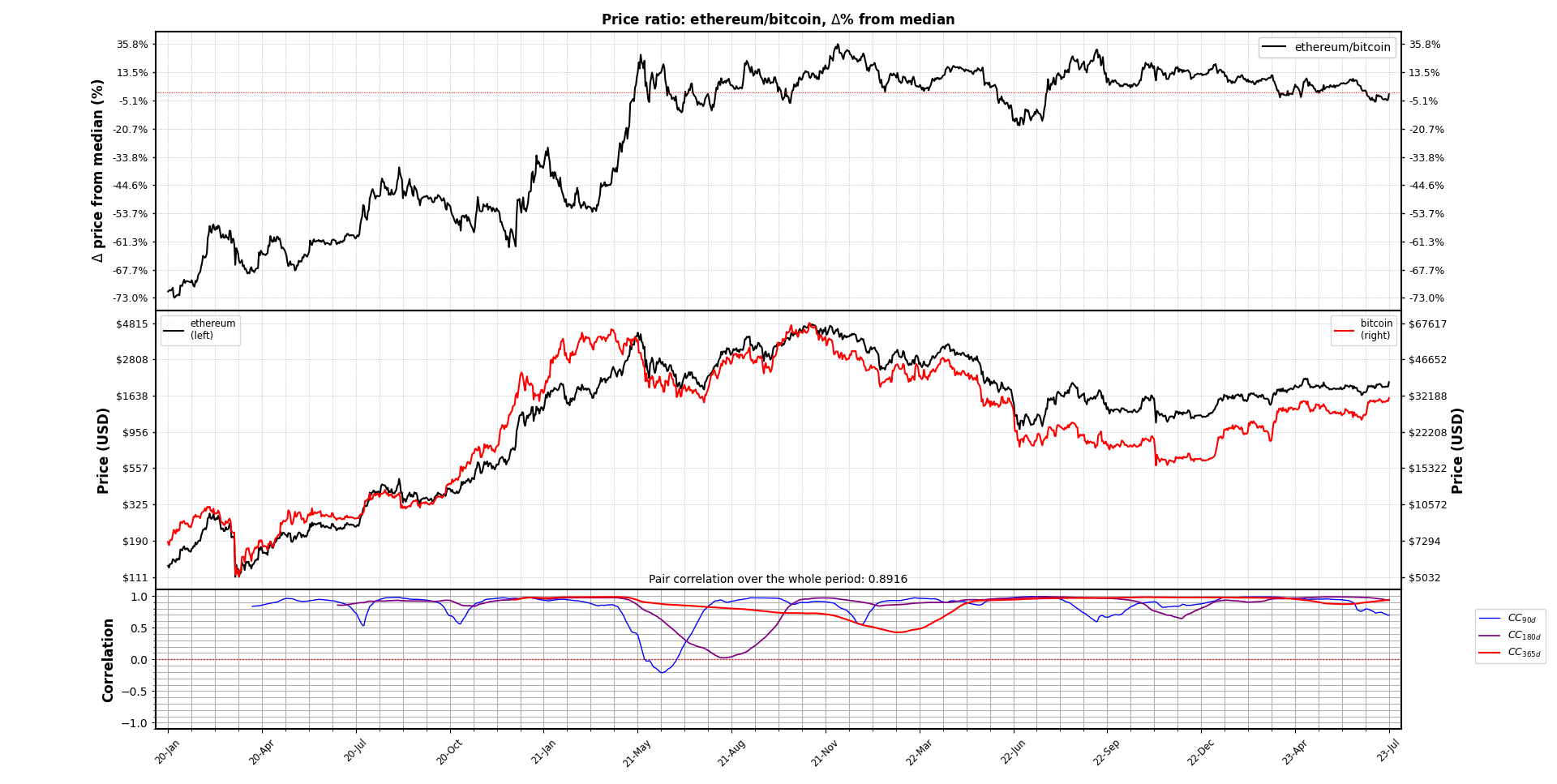

Simultaneously, Ethereum’s correlation with Bitcoin, which has held a high of 0.89 since January 2020, indicates Ethereum’s higher beta is also on a downward trend.

The 90-day correlation is witnessing a gradual descent, reaching levels unseen since September 2022. This evolving landscape suggests a developing independent trading pattern for Bitcoin, potentially indicating a new phase in the cryptocurrency market dynamics.

Glassnode

Glassnode