Insights

Bitcoin options volume hits highest level in almost two years – U.S. banking failures sparking volatility

Quick Take

- Options volume is at its highest level in almost two years; the total volume (USD Value) traded in options contracts in the last 24 hours.

- In BTC terms, this has surpassed over 100,000, or over $2.5 billion, in the past 24 hours.

- Three U.S. banks have collapsed in the past week, injecting volatility into the marketplace — which could be a reason for investors to hedge in the options market.

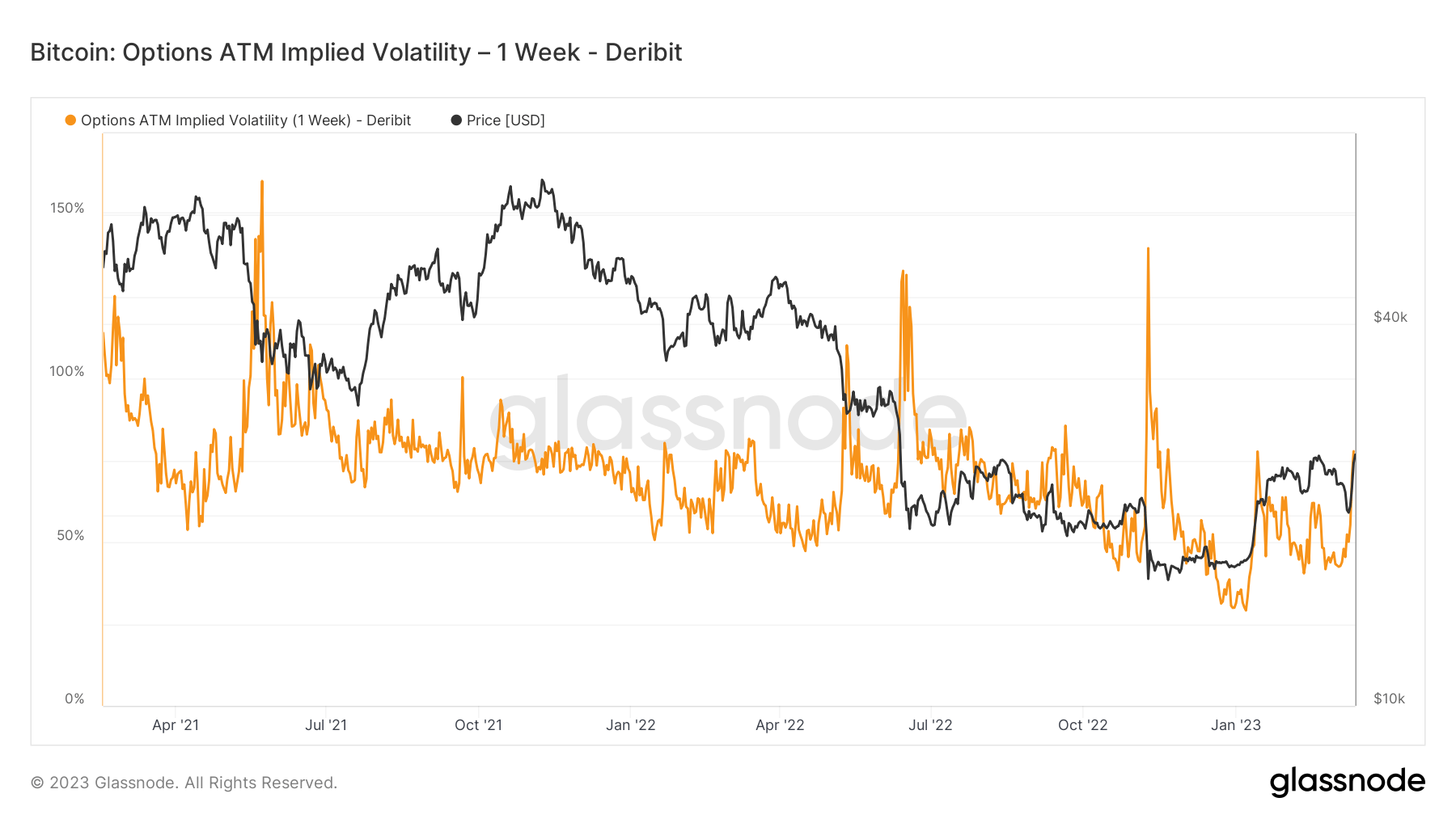

- As a result, options implied volatility has picked up massively, surpassing year-to-date highs at 78%.

- This has also seen a spike in the VIX and Move index in traditional markets.