Bitcoin options open interest soars to unprecedented $18 billion

Quick Take

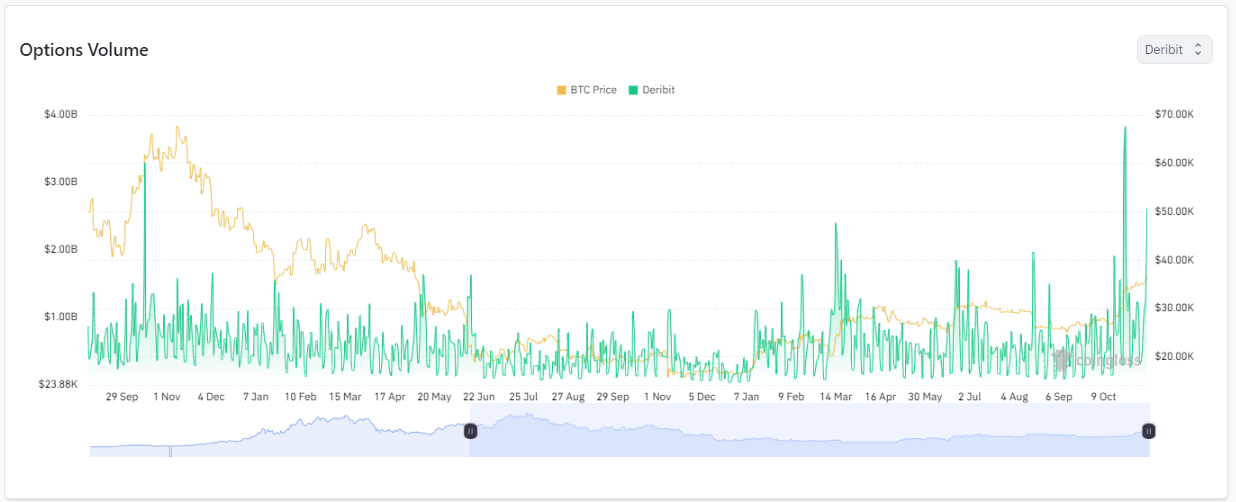

The Bitcoin options market is witnessing a surge not seen before, indicative of growing investor confidence and potential market trends. The Options Open Interest, which signifies the total funds allocated in options contracts, marked a record high on Nov. 10 with a notional value of $18.05 billion, equivalent to 491,000 BTC. The lion’s share of this momentum can be attributed to Deribit, contributing approximately $14.5 billion, according to Coinglass.

Further, the options volume on Deribit, defined as the total volume transacted in options contracts within the last 24 hours, peaked at $2.62 billion, making it the second-highest recorded volume this year, according to Coinglass.

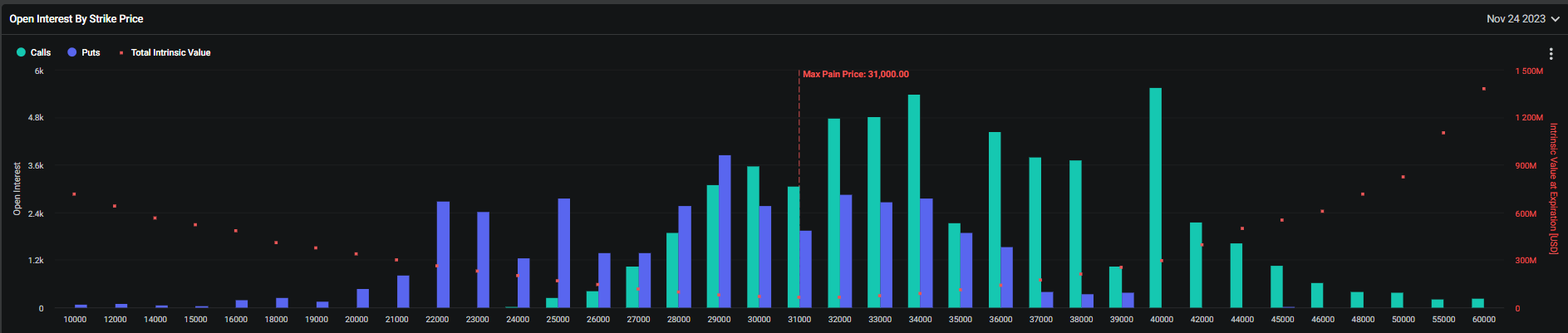

Notably, the total open interest of both call and put options by strike price for a specific contract scheduled for Nov. 24th highlights a ‘call wall’ at $40,000. This represents 5,528 Bitcoin in terms of call options, carrying a notional value of $203 million, according to Deribit. However, the landscape evolves as we approach the year’s end.

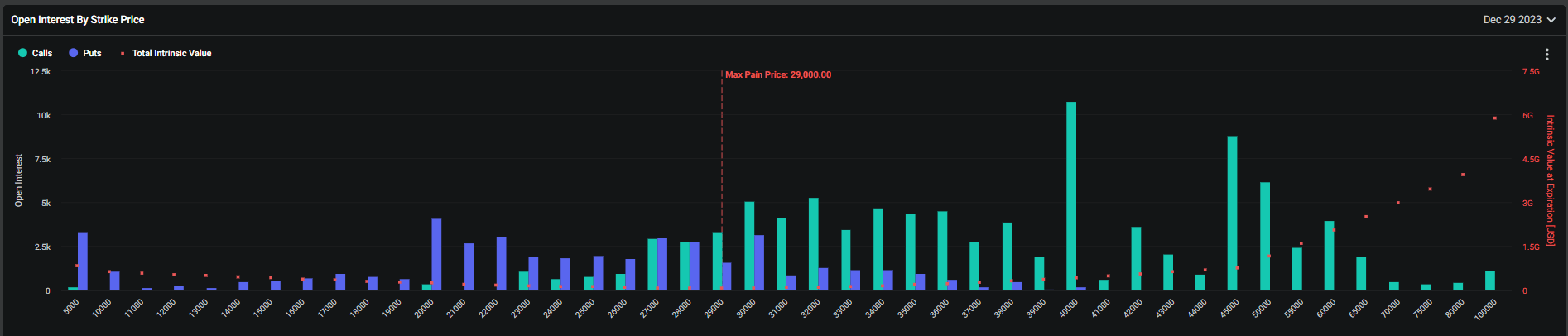

By Dec. 29th, the call options remain primarily at $40,000, but the notional value escalates to a staggering $400 million, doubling the previous figure.