Bitcoin open interest drops 5% within a 24-hour timeframe

Quick Take

Recent market data indicates a significant shift in the Bitcoin landscape, with a notable 5% correction observed in Asia’s markets. This downtrend pulled Bitoin’s value down to approximately $40,250 before shooting back to $42,250, marking a roughly 10% drop from its peak for the year, previously around $45,000. Around $400 million was also liquidated, coinciding with a subsequent reduction in open interest.

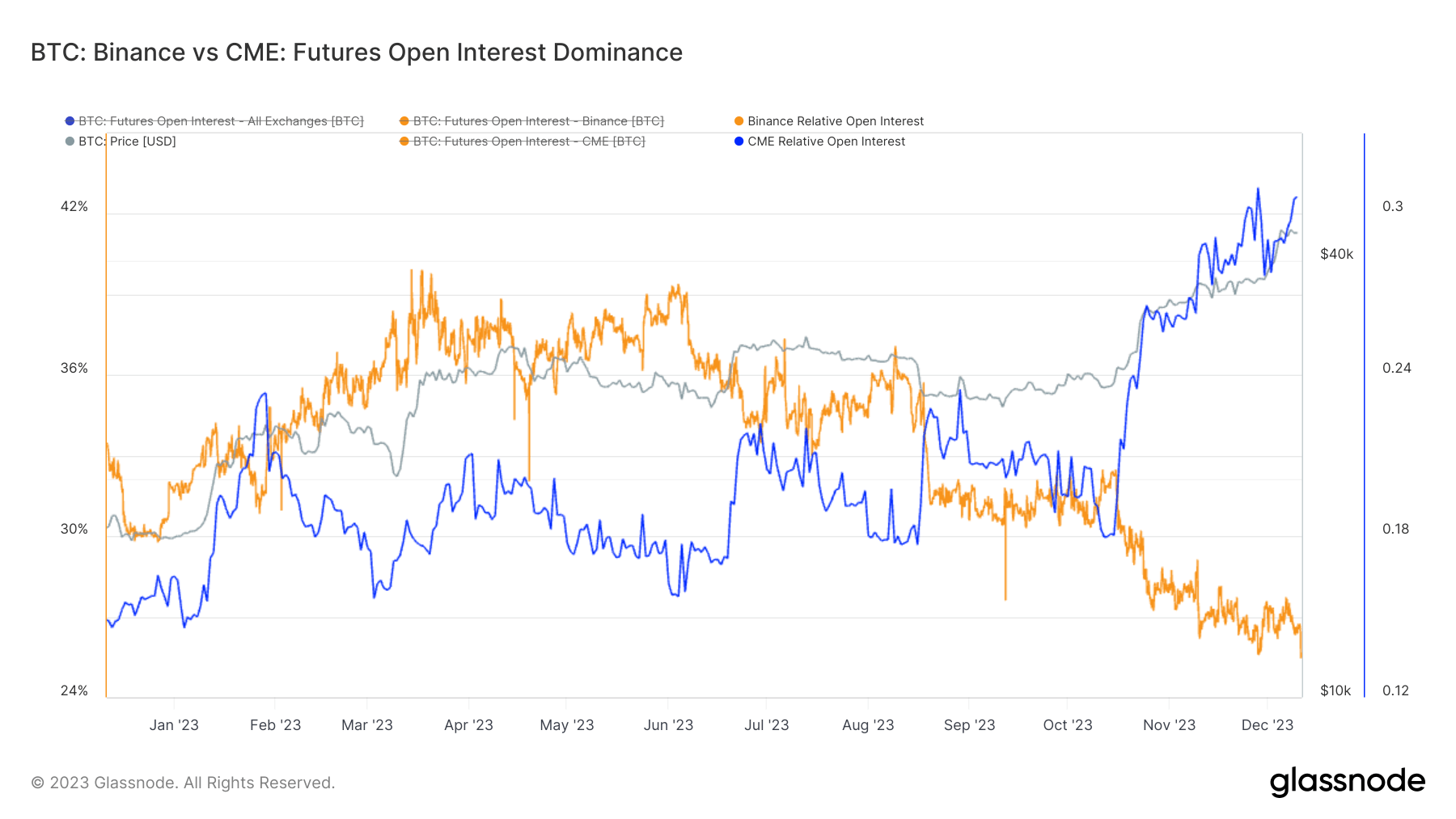

Information from Coinglass reveals a 5% decrease in open interest within a 24-hour, with Binance shouldering the majority of this fallout at about 9%. This shift widens the divergence between Binance and the Chicago Mercantile Exchange (CME). With less than 100,000 Bitcoin in open interest, Binance’s market dominance has shrunk to 25% and shows signs of further diminishing. In contrast, CME’s open interest has risen to 30%, suggesting an increasing influence in the cryptocurrency sphere.

Glassnode

Glassnode