Bitcoin liquidations total $310 million in the past two days

Quick Take

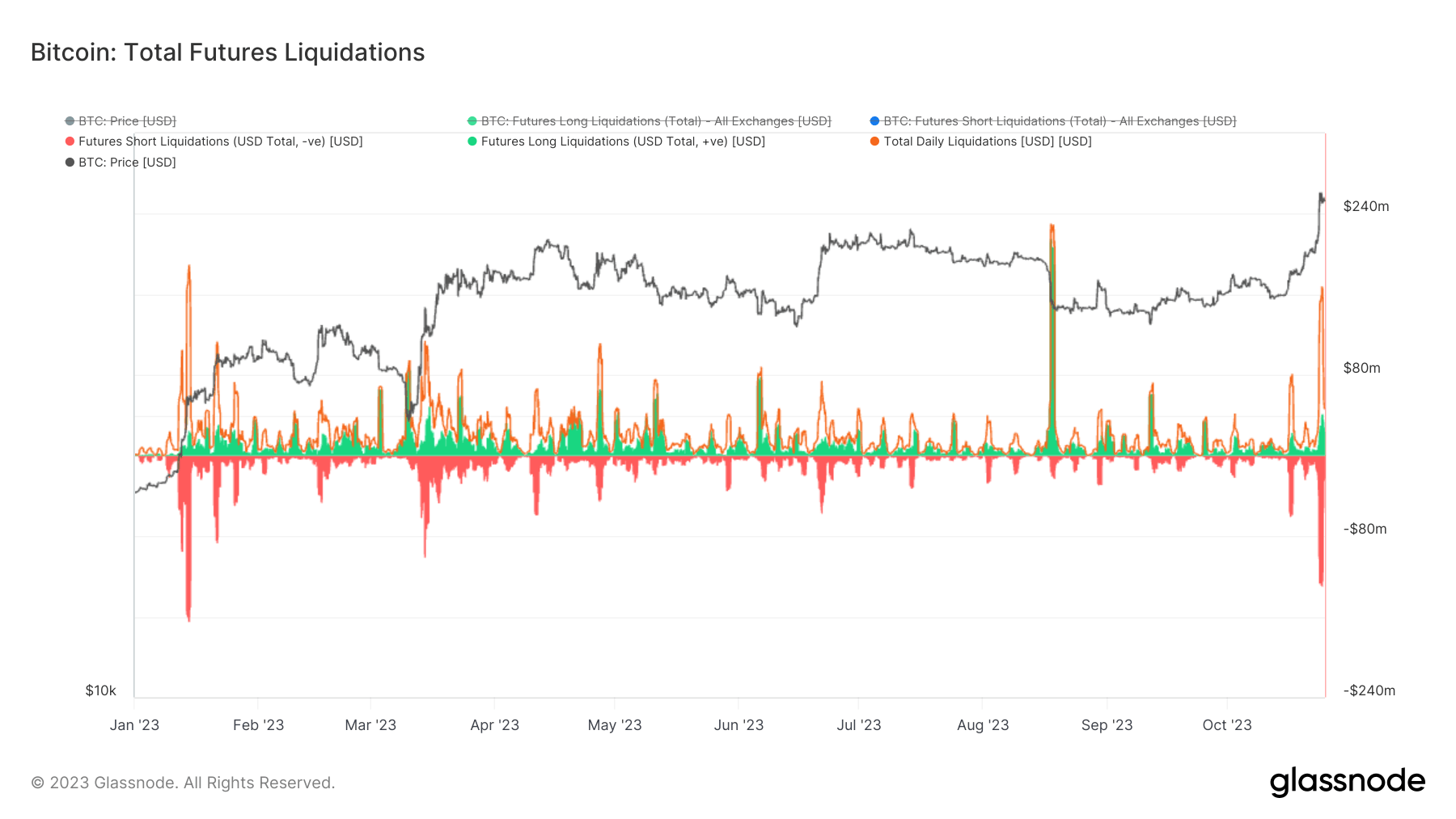

The recent surge in Bitcoin’s price has triggered a remarkable volume of liquidations. On Oct. 23, Bitcoin-specific liquidations amounted to $160 million, contributing to $190 million in liquidations that day. This trend persisted into Oct. 24, with short liquidations totaling $70 million and long liquidations totaling $50 million. Comprehensively, the liquidations for these two days amounted to an impressive $310 million.

This event registers as one of the most significant liquidations for the year. In comparison, other notable occurrences include the instance in January when Bitcoin’s price escalated from $16,000 to $20,000 and the period following the SVB collapse in March, where Bitcoin’s rebound from $20,000 to $27,000 instigated a substantial number of liquidations.

With these recent short liquidations, it’s pertinent to note that the largest long liquidation event occurred in August. This was when we witnessed long liquidations exceeding $210 million, coinciding with the price drop from $30,000 to $25,000.

The data signifies a direct correlation between sharp price movements in Bitcoin and the volume of liquidations.