Bitcoin inches up while leading ETFs slide further down in pre-market trading

Quick Take

As Bitcoin (BTC) charts a modest increase, pushing toward the $43,000 mark—an approximately 1% rise over the last 24 hours, exchange-traded funds (ETFs) are experiencing a rather contrasting trend.

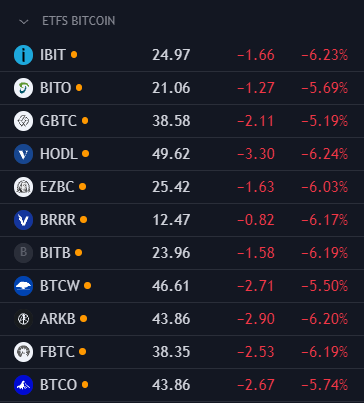

With the pre-market trading showing negative indicators, notable ETFs such as the IBIT BlackRock ETF and HODL Van Eck ETF have registered significant losses, down by -1.66% and -3.30%, respectively. These figures further accentuate the overall downward trajectory since their launch, with both ETFs recording a drop of over 6%.

The adverse trend isn’t confined to these ETFs alone. Data indicates that the majority of crypto-equities have succumbed to a similar fate, with MSTR down -0.27%, roughly 30% down from the Jan. 2 high at $706.

Notably, the price used to calculate the Net Asset Value (NAV) for Bitcoin ETFs is currently $42957.16 and will next be updated at 9 pm GMT on Jan. 16.

As the trading day culminates, CryptoSlate will continue monitoring to provide readers with the most recent and comprehensive analysis.