Bitcoin holds steady against economic headwinds, outshining Ethereum

Quick Take

In the midst of economic uncertainty, Bitcoin continues to dance around the crucial $70,000 level, demonstrating its resilience despite the DXY index steadily climbing towards 106 and US yields on the rise. As investors seek safe-haven assets, many are looking to gold for guidance, hoping that Bitcoin, often referred to as “digital gold,” will follow suit.

Despite a slight dip at the beginning of April, Bitcoin’s dominance in the digital asset market remains strong, currently at 54.6%, just below the cycle highs of 55.2%. This growth in dominance, up 6% year-to-date, indicates that investors, on aggregate, are favoring Bitcoin over other digital assets.

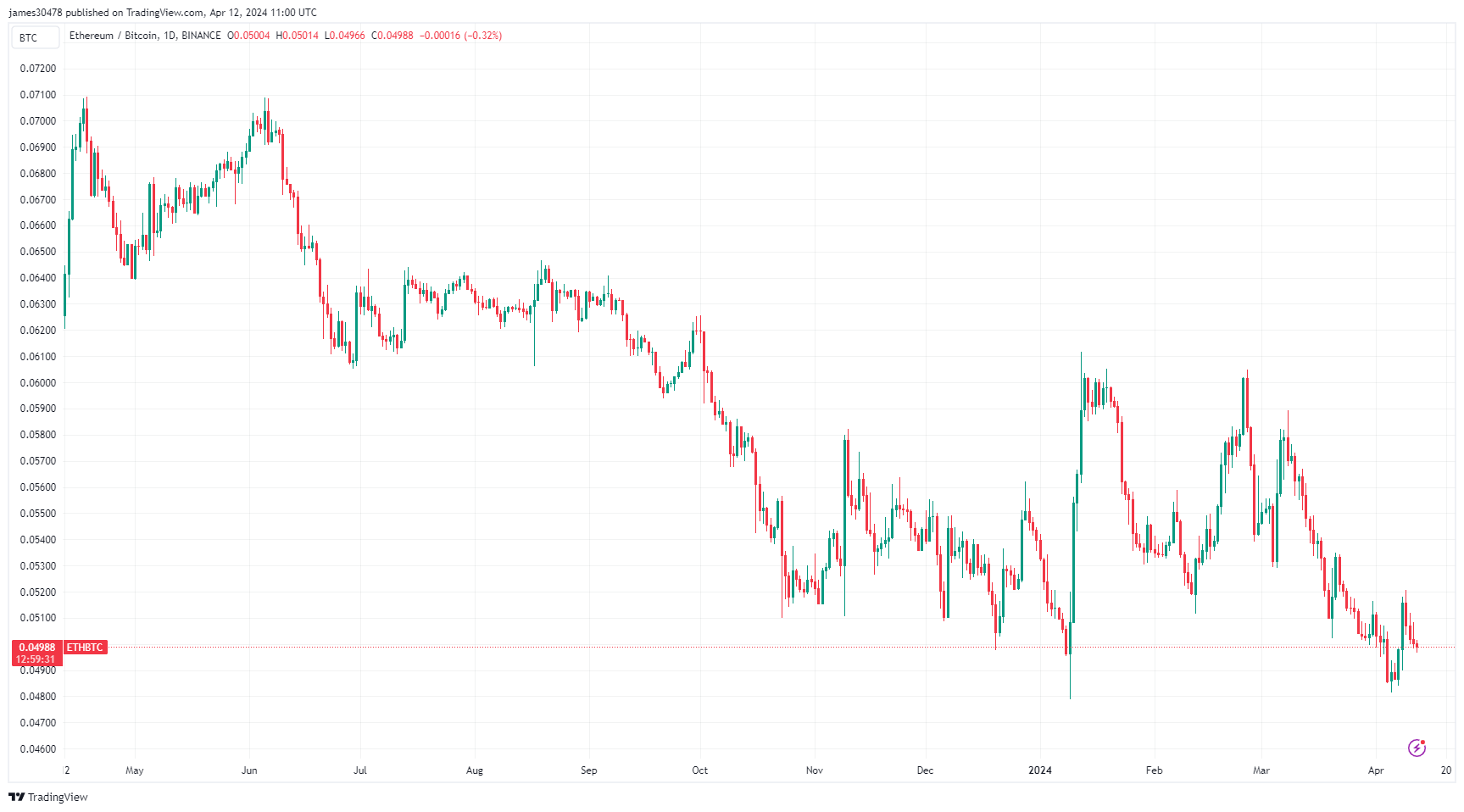

Another noteworthy trend is the ETH/BTC ratio, which remains below the critical 0.05 threshold, suggesting that Bitcoin is outperforming Ethereum. The ETH/BTC ratio has declined by 6% year-to-date and 20% over the past year. As the DXY index continues to surge, market observers are keeping a close eye on Bitcoin and gold, anticipating that they may continue to hold their ground or even follow the upward trend, providing a potential hedge against economic instability.