Bitcoin hash price hits $125k per Exahash, mirroring pre-2020 halving highs

Quick Take

The Bitcoin Hash Price, a pivotal barometer for daily miner incomes, has surged to a striking $125,000 per Exahash, a zenith not witnessed since July 2022. Glassnode analyst Checkmate highlighted that we have revisited levels mirroring a similar pre-halving period from 2020.

This metric, calculated by taking the ratio between total miner income (in USD or BTC – inclusive of subsidy and fees), and dividing by the current hash-rate (in EH/s), provides a daily snapshot of revenue per 1 EH/s of hashpower contributed by a miner to the network.

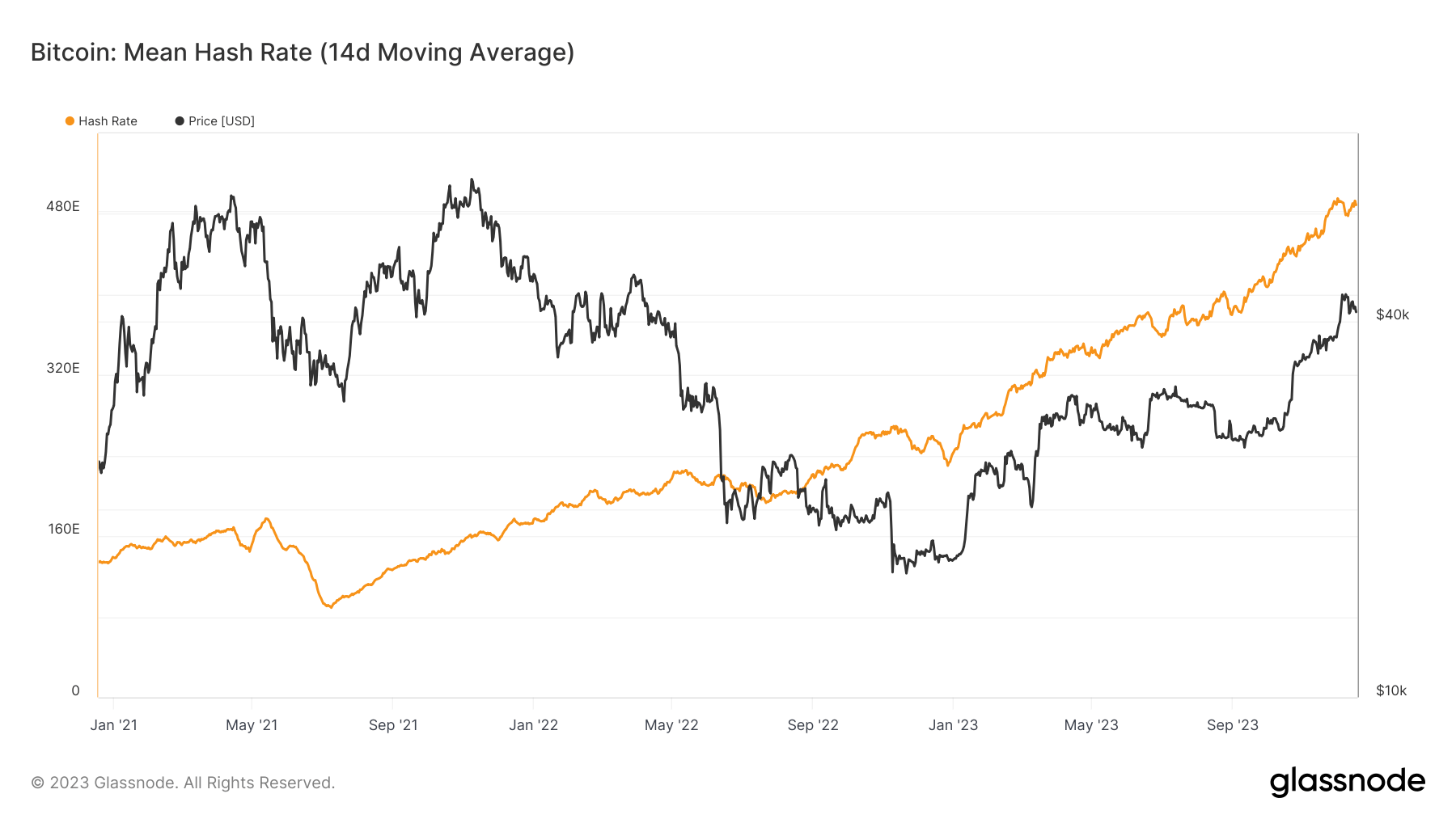

Interestingly, this upturn is counterbalanced by a commensurate uptick in transaction fees, which has absorbed the significant 137% escalation in hash rate since July 2021 as miners vie for the block reward, according to Checkmate. This intricate interplay of factors underscores the dynamic nature of the Bitcoin ecosystem.

In the near term, the next difficulty adjustment is slated for Dec. 22. With the current hash rate on an upward trajectory, it is projected to adjust positively by around 4% above current levels.

Glassnode

Glassnode