Bitcoin futures vs. spot price: Monitoring CME for market insights

Quick Take

Recent data from Coinglass shows CME’s percentage of open interest in Bitcoin futures has exceeded 26%, which equates to 119k Bitcoin in open interest contracts out of a total of 450k BTC. This highlights a significant investor interest in Bitcoin futures on the CME exchange.

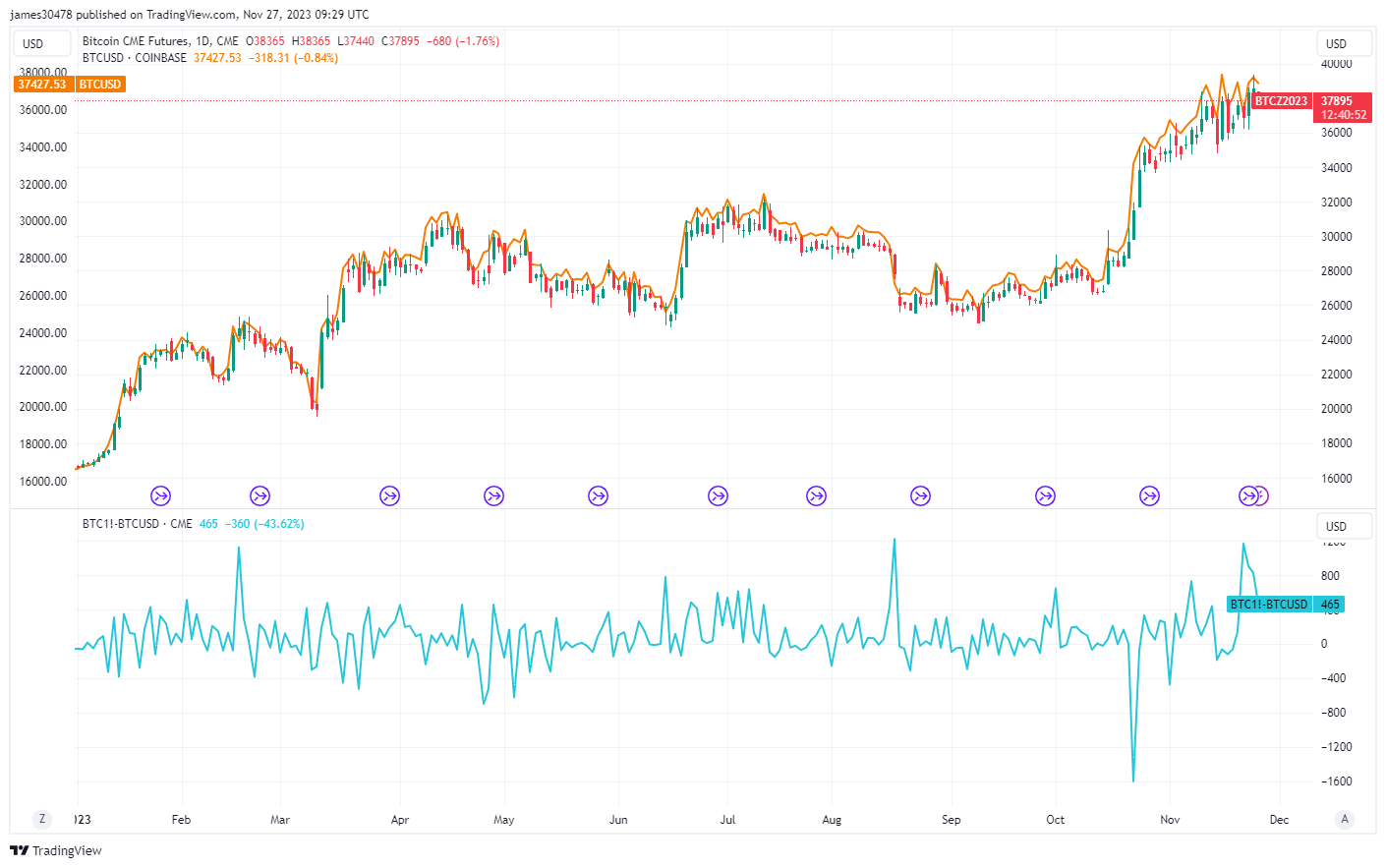

On Nov. 24, the BTC CME futures price reached a high of $39,340, closing at $37,895. In contrast, the Bitcoin spot price peaked at $38,400. This discrepancy, as high as $1,120, is noteworthy as it has occurred only three times this year, notably on Aug. 17 and Feb. 16.

Interestingly, there has also been an instance when the spot price surpassed futures. On Oct. 23, the difference amounted to $1,580. This irregularity underscores the necessity of monitoring the CME futures price for comprehensive market analysis.

CoinGlass

CoinGlass