Bitcoin futures volume surges 233% in 24 hours to reach $87 billion

Quick Take

Amid Bitcoin’s near 20% surge to the $35,000 mark within the past five days, the volume of Bitcoin futures contracts witnessed an astounding rise of 233% in just 24 hours, signaling a heightened level of trading activity.

This significant uptick in futures volumes, which allows traders to agree to buy or sell Bitcoin at a fixed price in the future, could be indicative of escalated speculative activity, hedging strategies, or a spike in institutional interest.

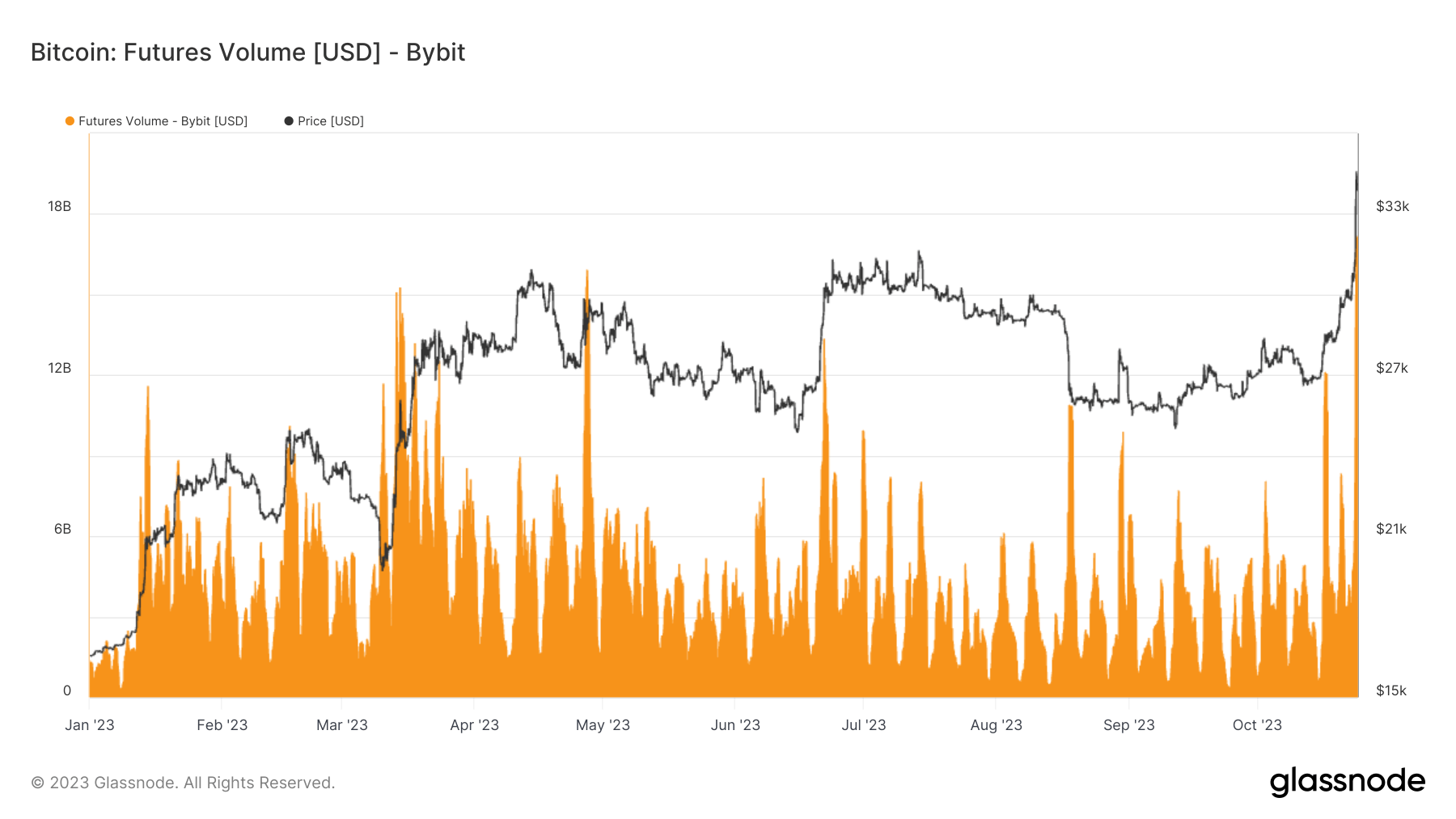

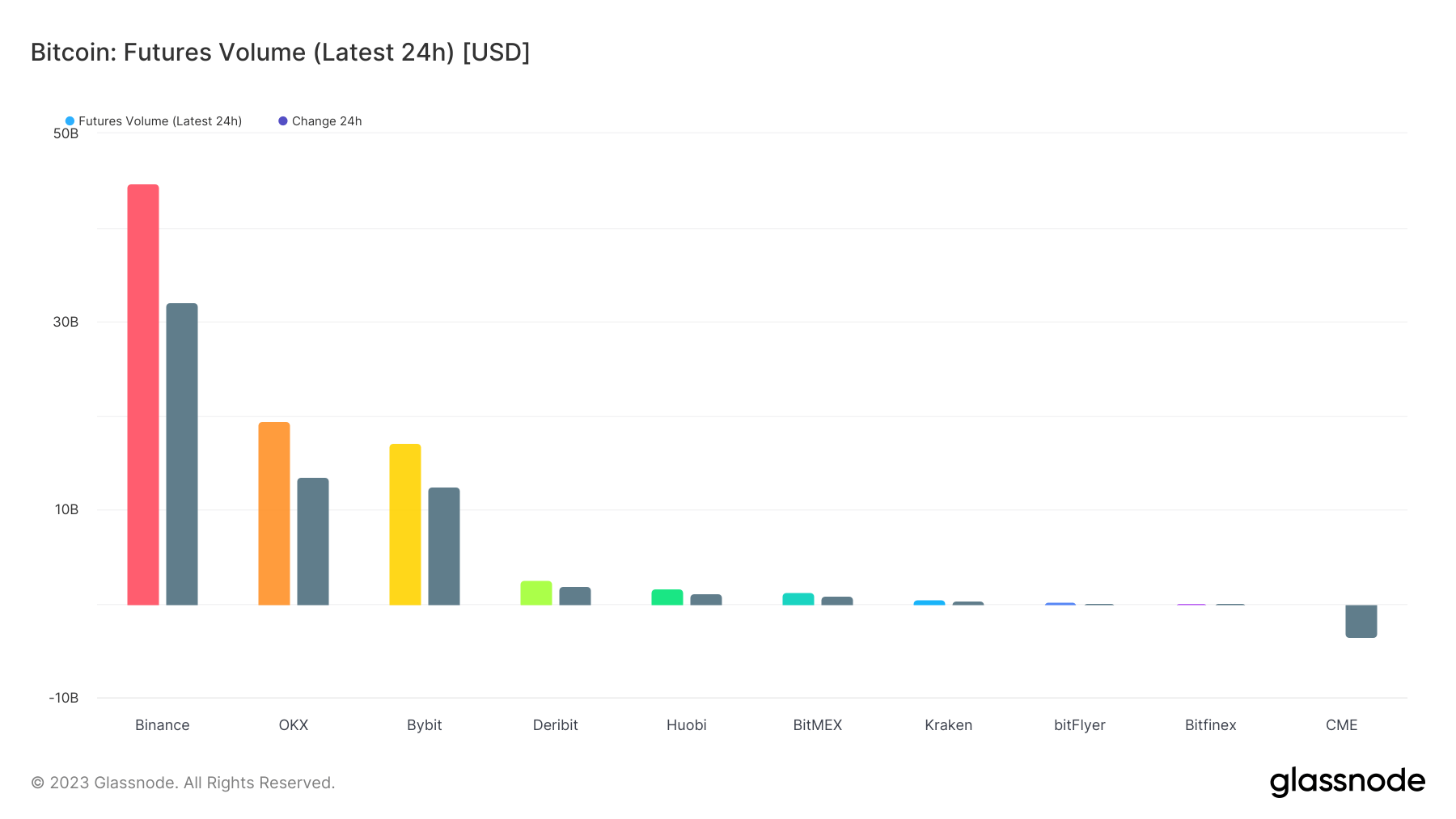

The aggregate volume of futures contracts reached a remarkable $87 billion on October 23, marking one of the highest recorded this year. A substantial portion of this activity can be attributed to ByBit and Deribit, with volumes of $17 billion and over $2 billion, respectively, significantly higher than their average volumes.

In addition to the aforementioned trends, other exchanges have also experienced a noteworthy increase in futures activity. For instance, Binance has recorded a surge in its futures volume to nearly $48 billion, marking a substantial rise of $30 billion within the past 24 hours. Similarly, OKX is not far behind, with its futures volume reaching approximately $20 billion, up by $15 billion in the same 24-hour span.

Glassnode

Glassnode