Bitcoin futures open interest reaches ATH

Bitcoin futures open interest (OI) reached an all-time high of $39.37 billion on July 29. The significant jump from the previous day’s OI of $37.49 billion follows Bitcoin’s spike to over $69,700 following the Bitcoin2024 conference in Nashville.

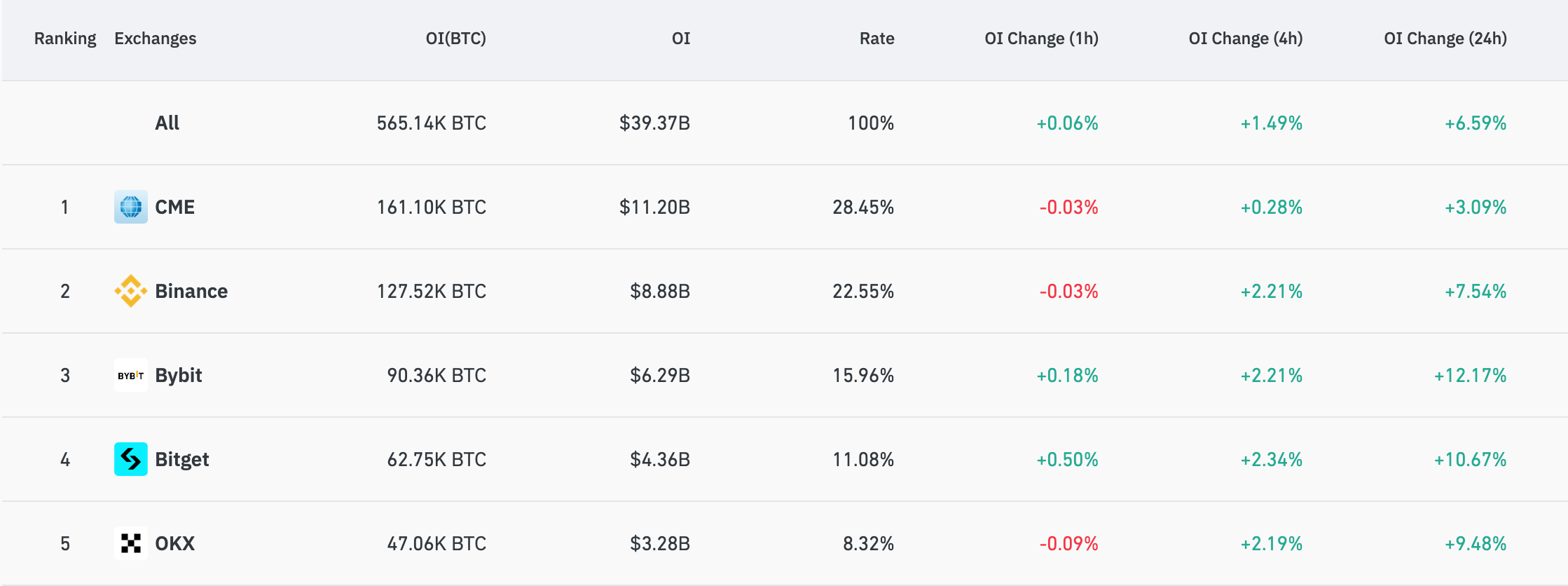

CME, having the highest OI at 161,100 BTC, shows significant institutional participation in the derivatives market. Binance, with the second-highest OI of 127,520 BTC, reflects an equally impressive retail interest in futures.

The rapid increase in OI, especially on platforms like Bybit and Bitget, shows a high level of speculative trading. Traders seem to be leveraging futures to capitalize on the price surge. Major crypto conferences often catalyze market enthusiasm; last week’s Bitcoin2024 was no exception. The bullish sentiment comes after President Donald Trump’s keynote speech and the subsequent announcement of a Bitcoin reserve plan for the US.

CoinGlass

CoinGlass