Insights

Bitcoin futures open interest at CME reaches 20% of overall BTC futures OI

Quick Take

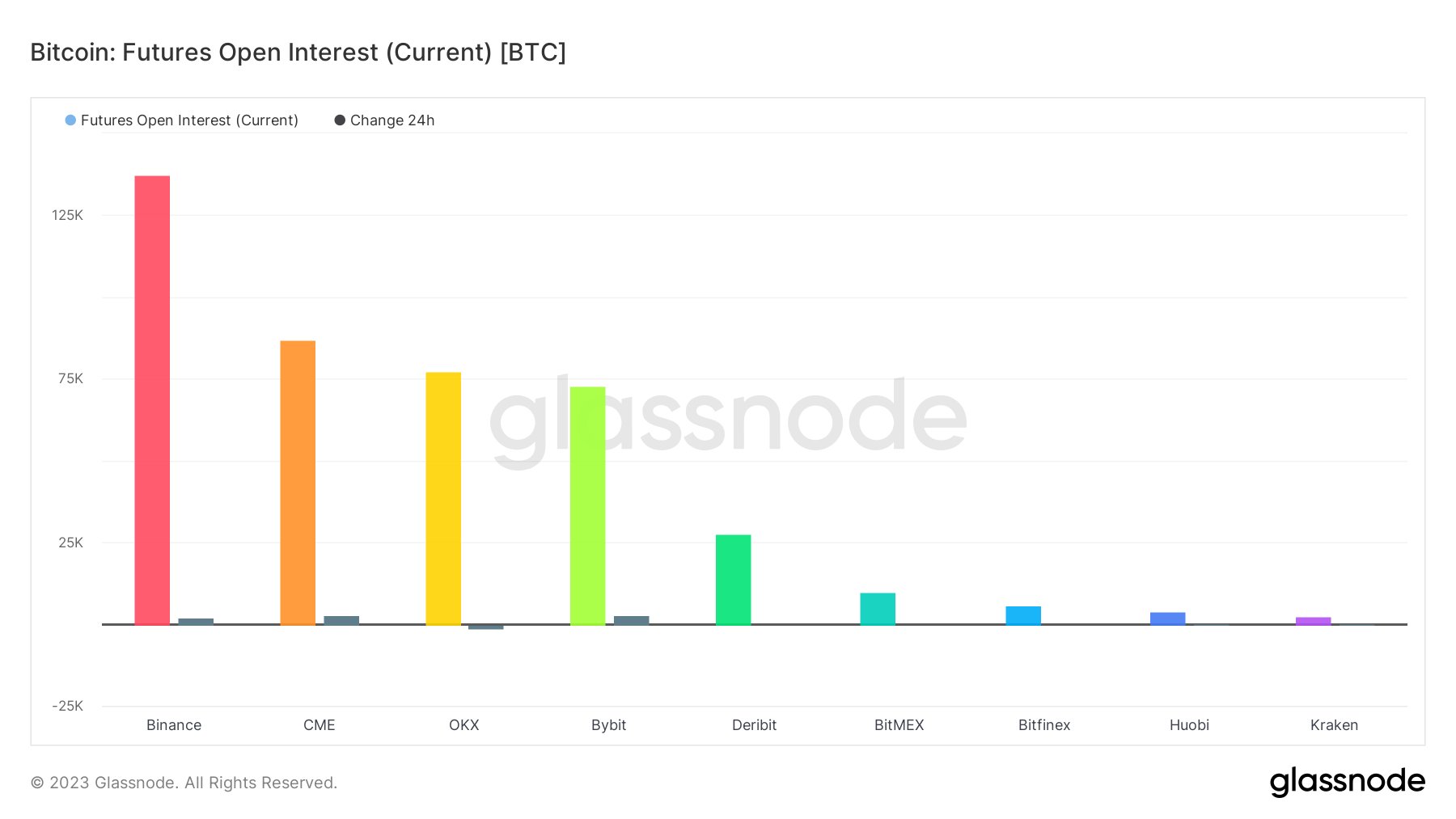

- Cryptoslate reported on Jan. 24 that the CME exchange saw 84,000 Bitcoin, or $2 billion, allocated in futures contracts in the last 24 hours.

- A further 2,715 BTC were allocated into futures open interest (OI) in the past 24 hours, now totaling 86,950 BTC.

- The futures OI in CME accounts for 20% of the futures open interest in all exchanges, the highest since the November 2021 bull run.

- Total futures OI is 420,000 BTC, or about $9.5 billion.

Why is CME popular?

- CME is accessible for TradFi funds, as it’s regulated and uses a central counterparty clearing houses (CCPs) clearing model

- It’s easier for institutional speculators to trade BTC as it’s the same place they would trade commodity futures and, in general, relatively expensive for the average investor.