Insights

Bitcoin Futures ETF BITO sees biggest weekly inflow in a year

Quick Take

- Eric Balchunas, Bloomberg’s Senior ETF Analyst, recently highlighted a significant achievement for the Bitcoin Futures ETF, $BITO. In its most substantial weekly inflow in the past year, the ETF’s assets have surpassed the $1 billion mark once again.

- On Friday alone, it traded shares worth half a billion dollars, an impressive feat it had only accomplished about five times prior to this.

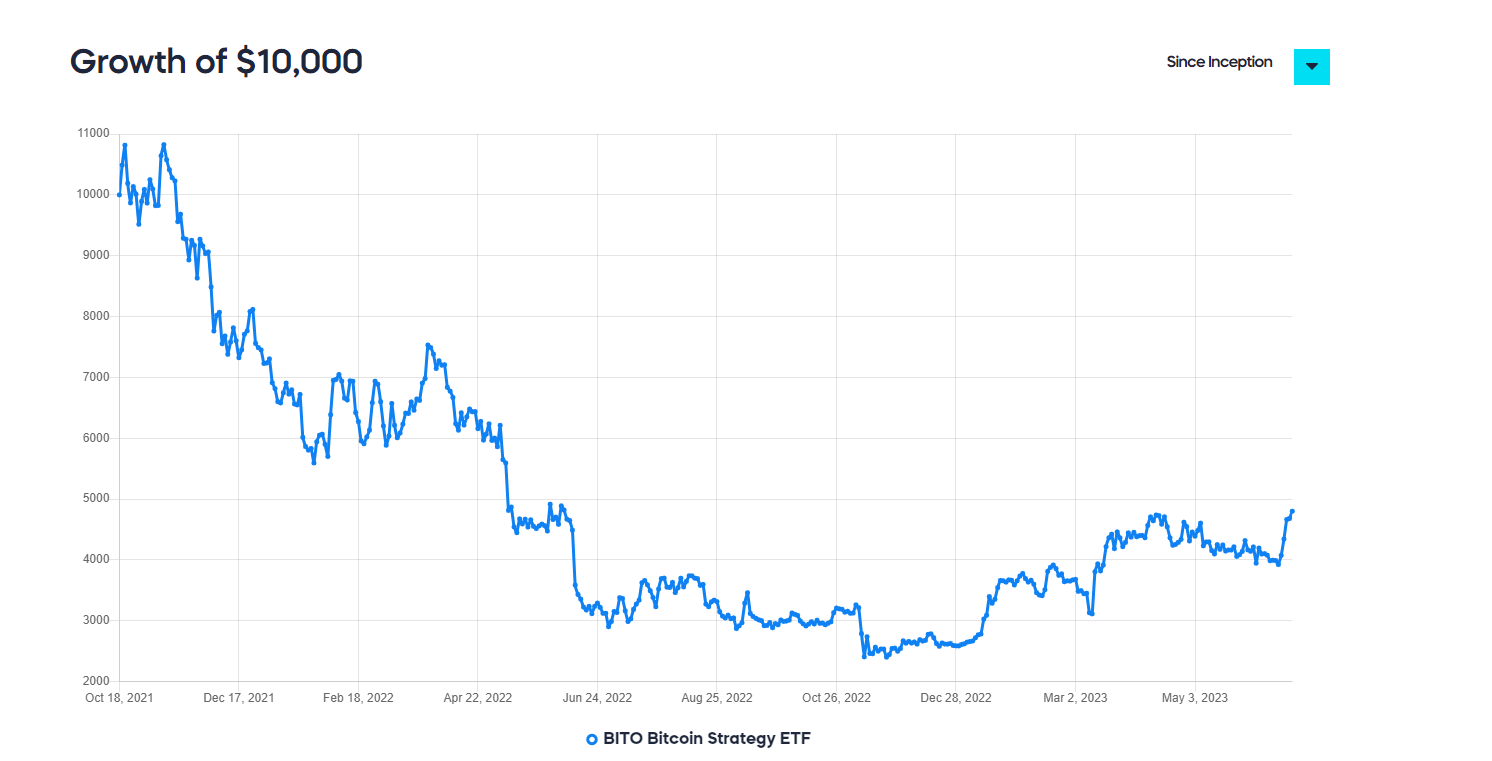

- Established in November 2021, at the height of the Bitcoin bull cycle, $BITO gives investors a pathway to gain exposure to Bitcoin through an ETF. However, its current performance shows a downturn, with a significant -52% drop.

- Investors who initially injected $10,000 into $BITO would now possess approximately $4,800, underscoring the ETF’s challenging market conditions.

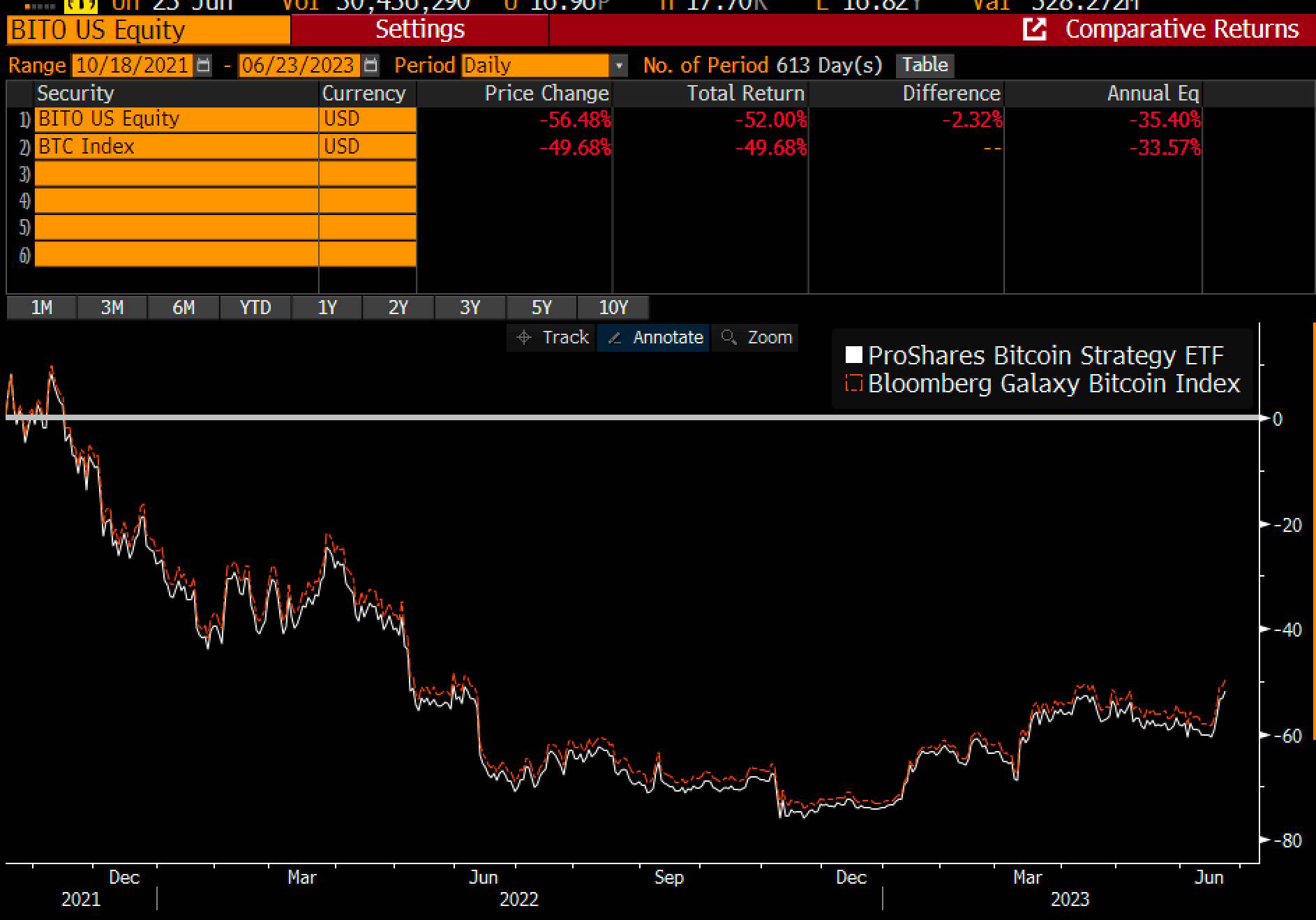

- Despite being a futures ETF and not a spot ETF, Balchunas pointed out that $BITO closely shadows the spot price of Bitcoin.

- Balchunas suggested a considerably lower impact than anticipated, stating, “It’s lagged spot by 1.05% annually, but its fee is 0.95%, leaving only 10 basis points of roll (extra) costs, which is basically a rounding error. Many anticipated a discrepancy of over 5% a year.”