Bitcoin falls below $57k as $13 billion in leveraged shorts placed on major exchanges

Since February, Bitcoin has fallen to its lowest price, breaking below $60,000 and hitting $56,900 as of press time. The price is now 23% below its recent pre-halving all-time high of $73,000.

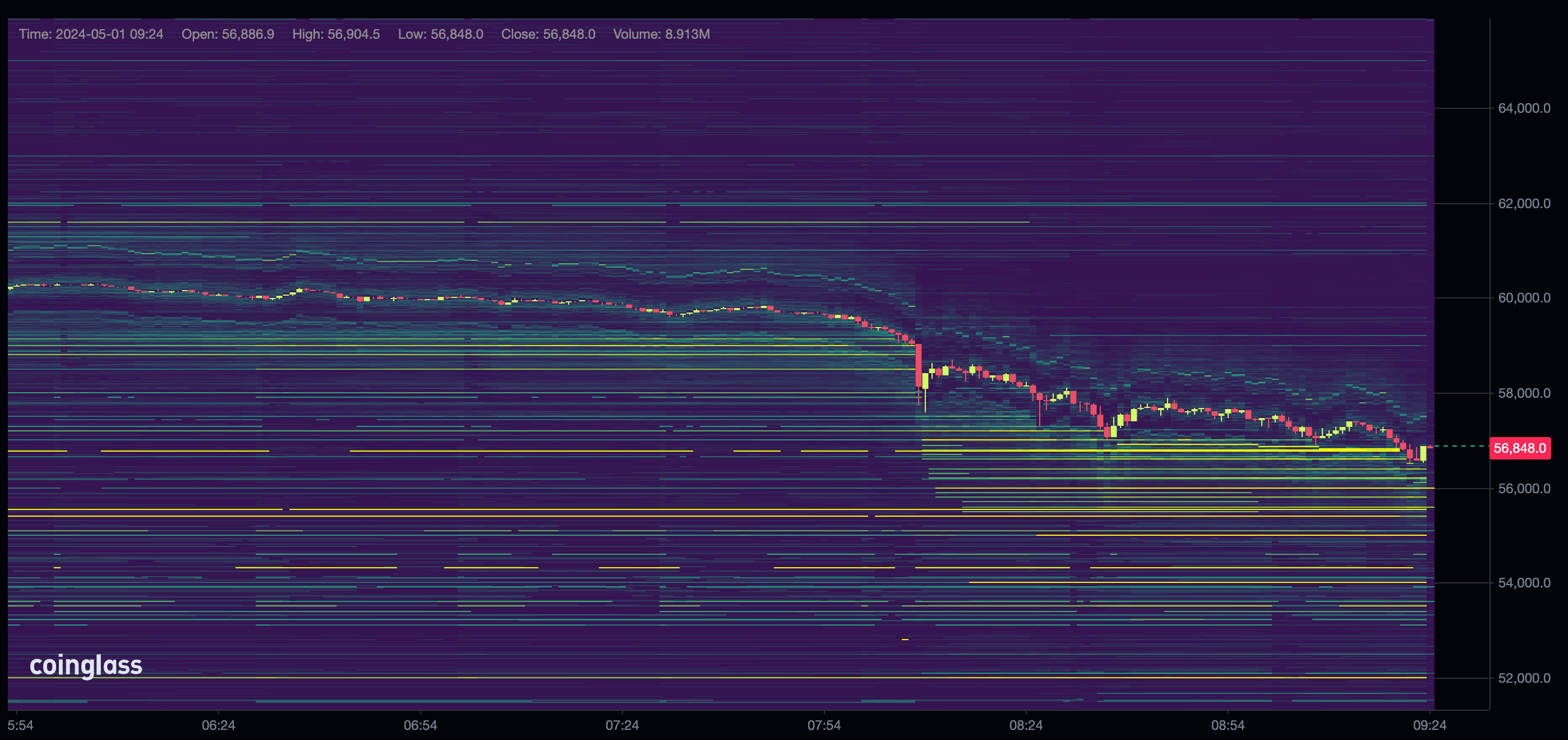

Data from Coinglass shows that Binance, the most liquid exchange for Bitcoin trading, has several buy walls in the order book down to around $50,000. Each yellow line represents at least 200 BTC in orders, roughly $11.5 million.

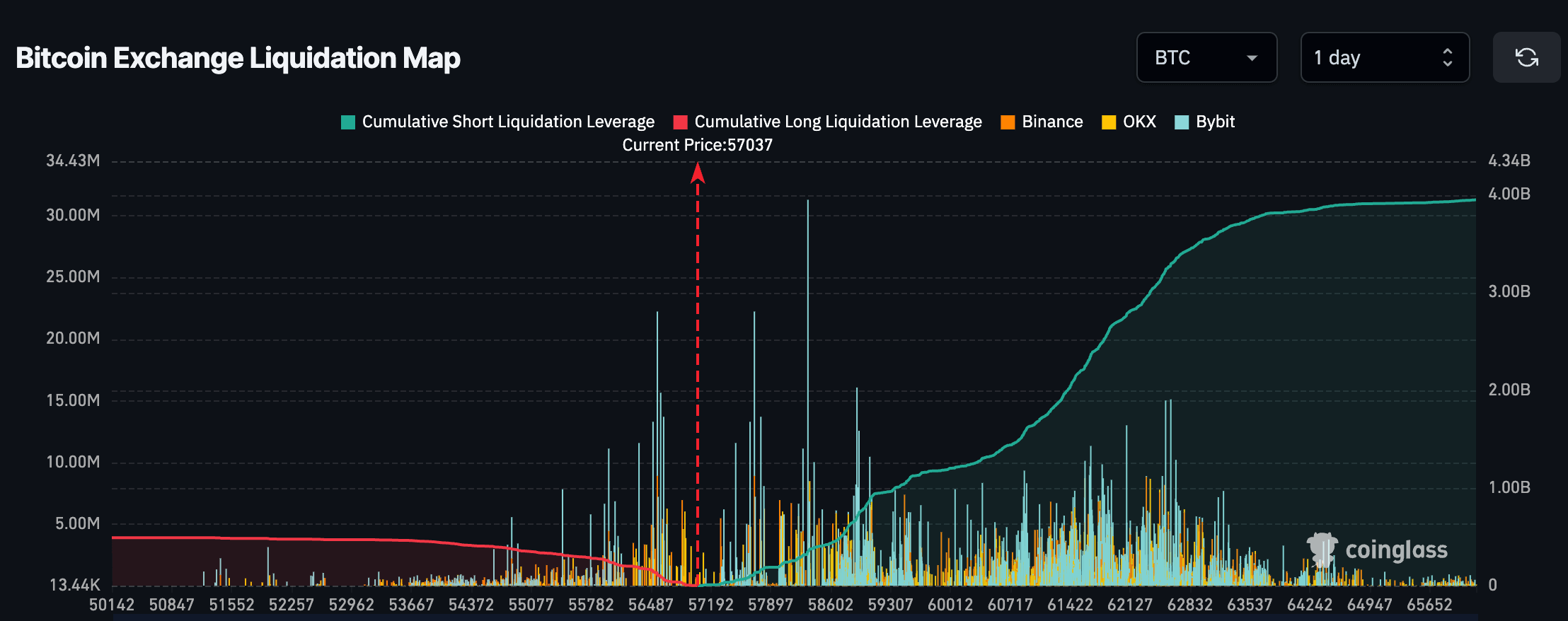

The liquidation map for Bitcoin across Binance, OKX, and Bybit shows almost $4 billion of leverage in notional value over the past day. Much of the leverage comes in the form of short positions held above $61,000.

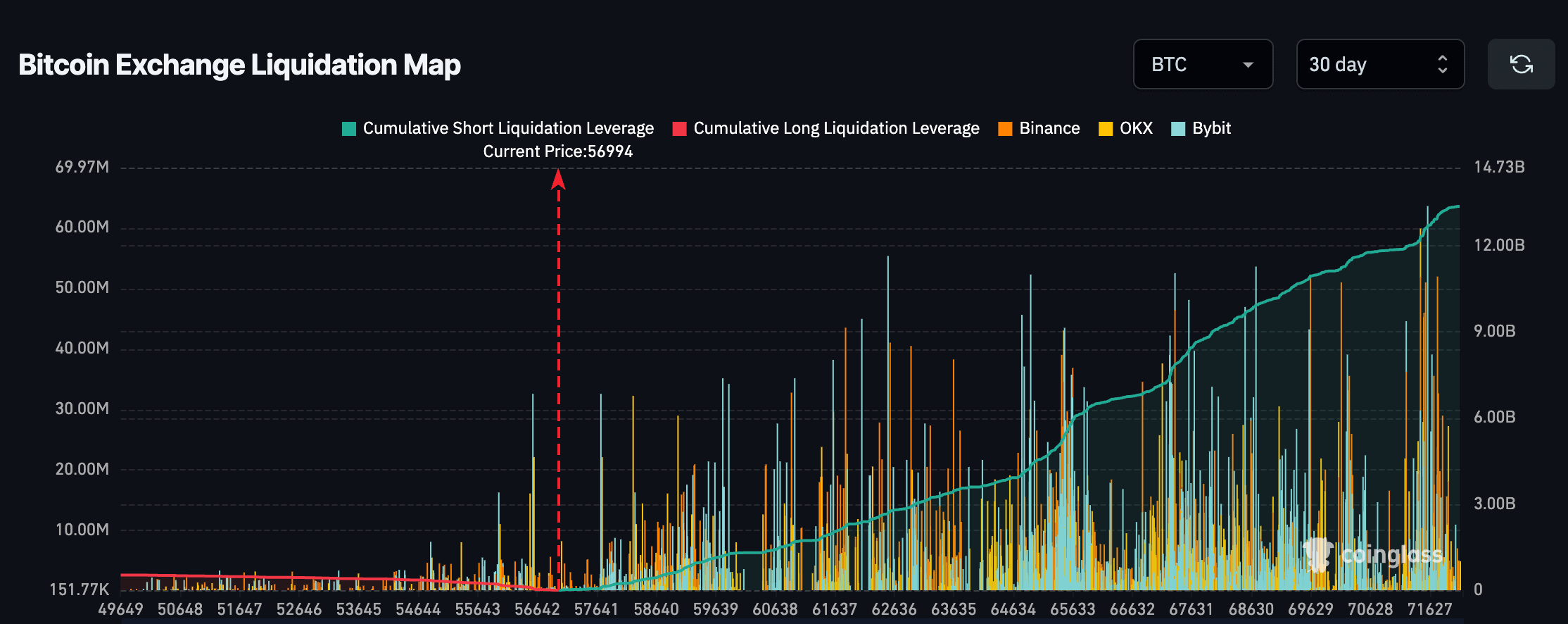

Over the past 30 days, almost $13 billion worth of leveraged short positions have been placed between $57,000 and $72,000.

CoinGlass

CoinGlass