Bitcoin ETFs shed $168 million on 7% drop

Quick Take

On Aug. 5, Bitcoin (BTC) suffered a significant 7% drawdown. The digital asset hit a local bottom at $49,000 before rallying to approximately $54,000 once the US markets opened.

Data from Farside highlights substantial outflows from Bitcoin ETFs on this day, totaling $168.4 million. Leading the outflows were Grayscale’s GBTC with $69.1 million, ARK’s ARKB with $69.0 million, and Fidelity’s FBTC with $58.0 million. Notably, FBTC has now faced outflows for six consecutive trading days. In contrast, Grayscale’s mini ETF BTC saw inflows of $21.8 million, while Bitwise’s BITB and Wisdom Tree’s BTCW had smaller inflows of roughly $3.0 million each. BlackRock’s IBIT ETF reported no inflows or outflows, maintaining a unique record of only one outflow day since its inception. The total inflows for Bitcoin ETFs now stand at $17.3 billion.

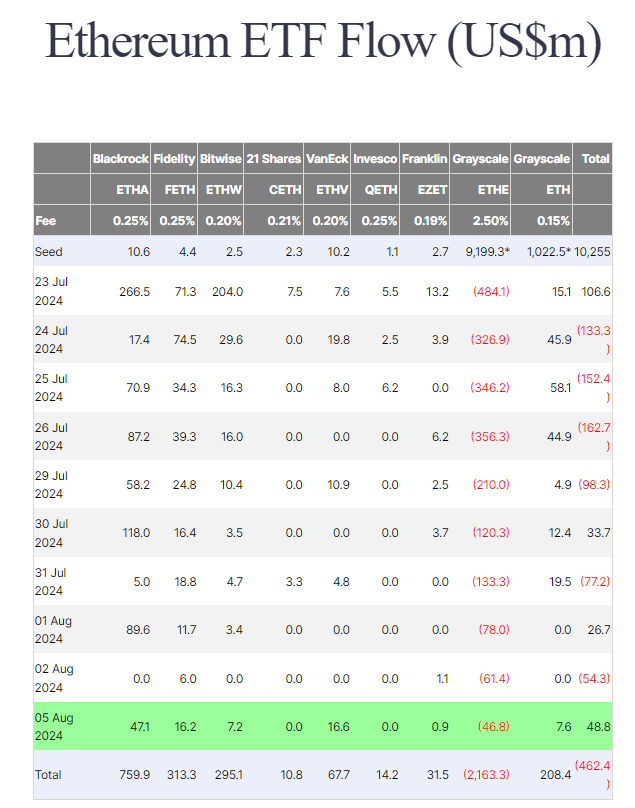

Ethereum (ETH) ETFs presented a different picture, with an inflow of $48.8 million on Aug. 5. Six out of nine ETF issuers reported inflows. However, Grayscale’s ETHE continued to see outflows, albeit reduced to $46.8 million. The total outflows for ETH ETFs have now reached $462.4 million, according to Farside data.

Farside Investors

Farside Investors