Bitcoin ETF inflows plummet from $263.2 million to $12.8 million

On Sept. 16, Bitcoin ETFs saw net positive flow of $12.8 million. This is a significant drop from the $263.2 million net inflow observed on Friday, Sept. 13.

Such a sharp drop is due to five of the nine tracked spot ETFs having a zero net flow on Monday. Bitwise, Ark, Invesco, Valkyrie, and Wisdom Tree all saw zero flows on Sep. 16. Grayscale’s $20.8 million outflow also contributed to the drop. While BlackRock’s IBIT saw zero flows on Friday, it recovered with a $15.8 million inflow on Monday. Fidelity and VanEck saw modest inflows.

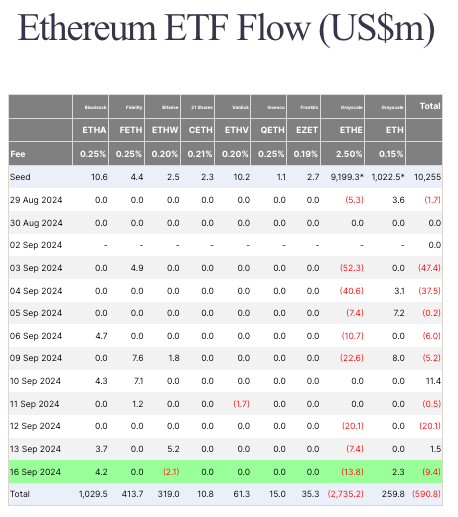

Ethereum ETFs recorded a negative flow once again after seeing net inflows of $1.5 million on Friday. Throughout September, Ethereum ETFs only had two days of positive flows. On Sept. 16, the $13.8 million outflow from Grayscale’s ETHE pushed flows deep into the red with a net outflow of $9.4 million. This brings the total outflows to $590.8 million.

Farside Investors

Farside Investors