Bitcoin drops as S&P US composite PMI Flash surges, Ethereum remains resilient

Quick Take

According to Trading Economics, the S&P Global US Composite PMI Flash experienced a significant surge in May, reaching 54.4, up from April’s 51.3. This marks the highest level since April 2022, surpassing the consensus expectation of 51.1. The manufacturing and services sectors exceeded predictions, with the Manufacturing PMI Flash at 50.9 against a consensus of 50 and the Services PMI Flash at 54.8, compared to the expected 51.3.

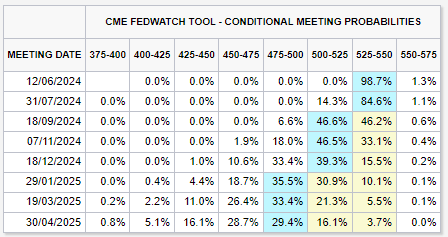

In response, yields have edged slightly higher, influencing CME futures to adjust expectations. The market is now pricing in only one rate cut in 2024, with the possibility of rate hikes starting to be considered.

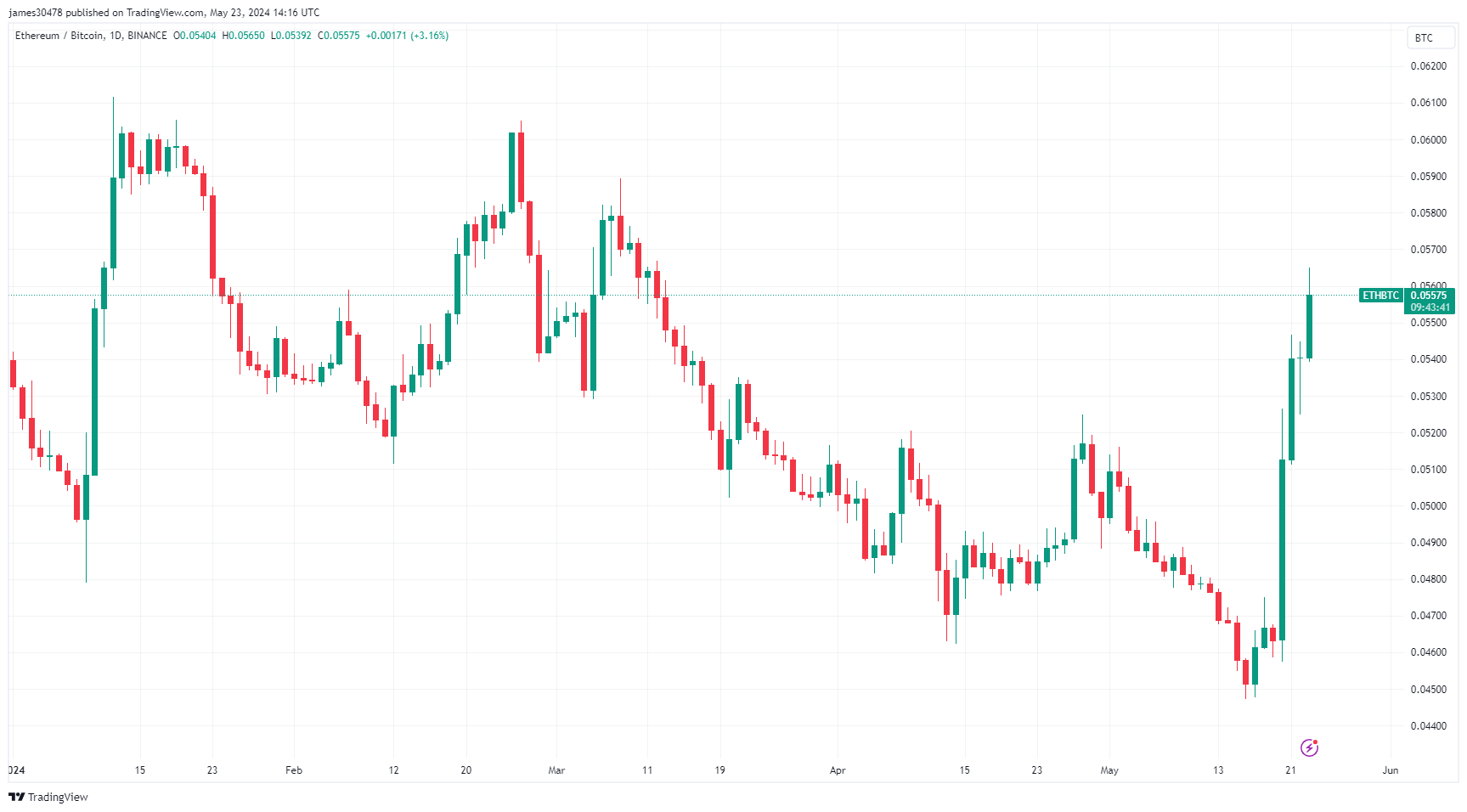

The financial markets reacted to these developments, impacting digital asset prices. Bitcoin fell below $68,000, reflecting market adjustments. However, Ethereum showed resilience, trading at approximately $3,790. Additionally, the ETHBTC ratio continued its upward trend, standing at 0.556, up over 3% for the day.