Bitcoin defies market trends with 27% rise during geopolitical tensions

Quick Take

The recent conflict in Israel has triggered a sharp market response from a wide array of assets.

Bitcoin saw a significant surge of 27%, growing from around $28,000 to approximately $35,000 since Oct. 7.

On the contrary, gold exhibited a less pronounced reaction despite traditionally being considered a secure geopolitical hedge. After an initial breakthrough of $2,000, it saw a subsequent 2% decline, leaving its overall increase at just 5%, trading at $1,960 at press time.

The oil market, often responsive to geopolitical unrest, experienced a surprising downturn. Brent crude oil and WTI crude oil have depreciated by over 8% and 11%, respectively. According to several economic theories, this unusual trend indicates that oil prices are linked to economic growth.

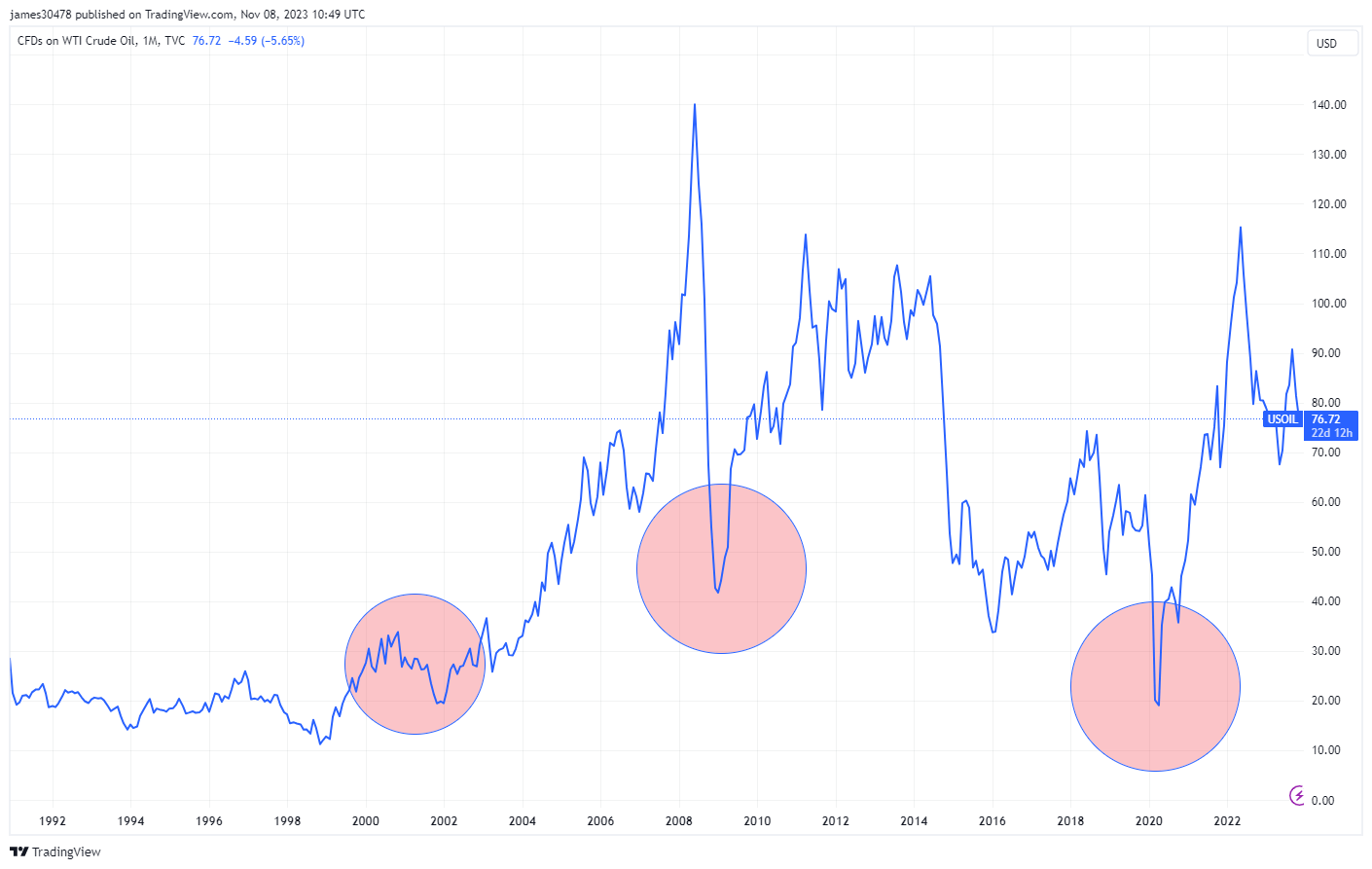

During the past three recessions in 2000, 2008, and 2020, there has been a significant collapse in the oil market each time. This pattern suggests that the current decline in oil prices could potentially be signaling an impending economic slowdown or recession.

As central banks grapple with some of the steepest interest rates in recent memory to curtail growth and inflation, the oil industry is seemingly bearing the brunt, with WTI and Brent crude oil trading around $76.71 and $80.99, respectively.