Bitcoin bucks the trend, outperforms MicroStrategy with ETF speculation fueling market moves

Quick Take

Bitcoin displayed notable resilience in the latest market events, from $43,300 to $47,200. This surge markedly increased its market capitalization, moving from $850 billion to $925 billion. Jan. 8 was the fourth most significant one-day change in Bitcoin market cap since Dec. 2021.

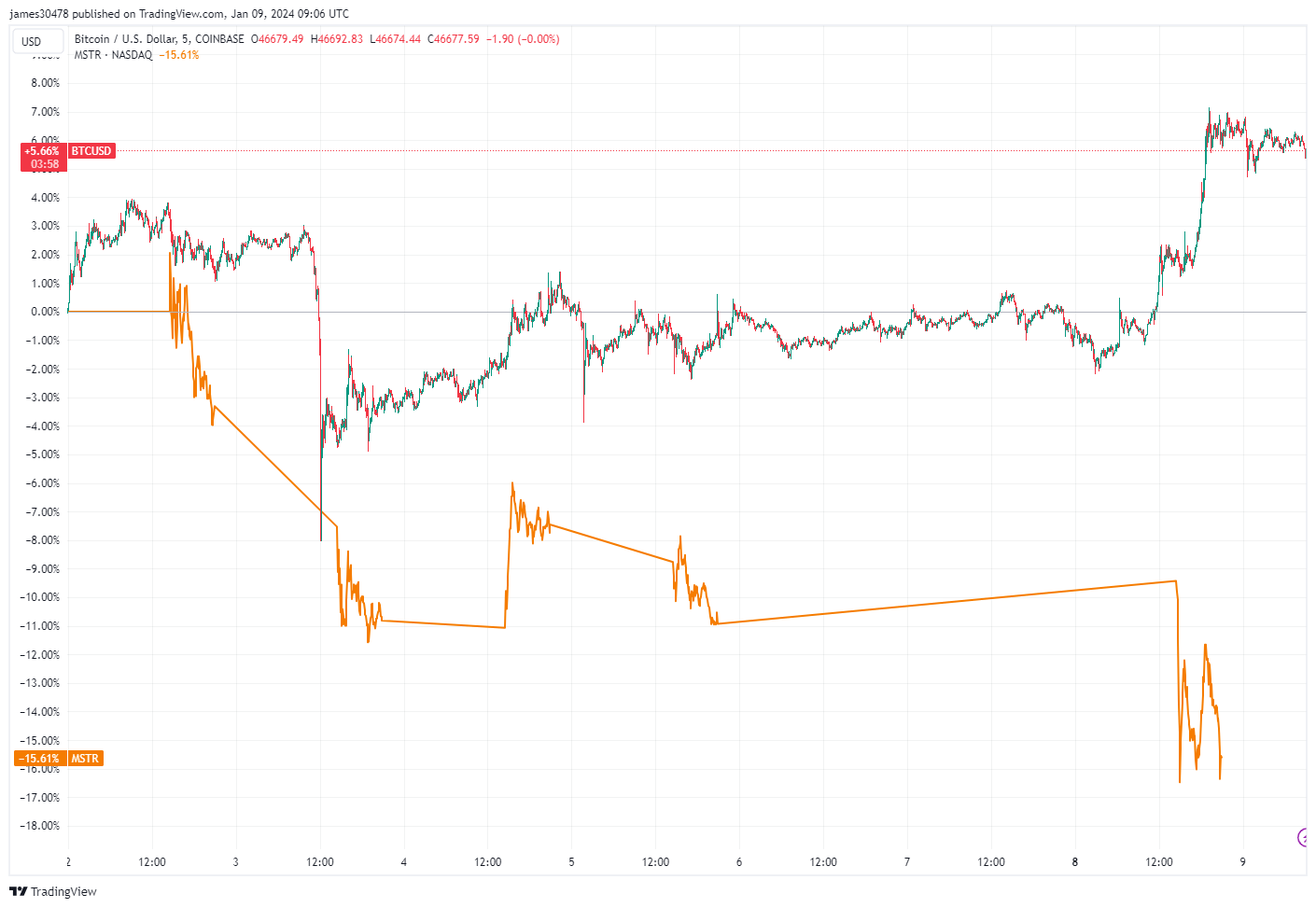

Interestingly, a divergence has been observed in the performance of Bitcoin and MicroStrategy since Jan. 1, 2024. While Bitcoin has climbed 5.6%, MicroStrategy recorded a drop of 15.6%. It’s believed that the impending approval of a Bitcoin ETF is a crucial factor behind this discrepancy. The ‘MicroStrategy Premium’ observed before a pending ETF announcement is now leading investors to divest from MicroStrategy in favor of the upcoming ETF.

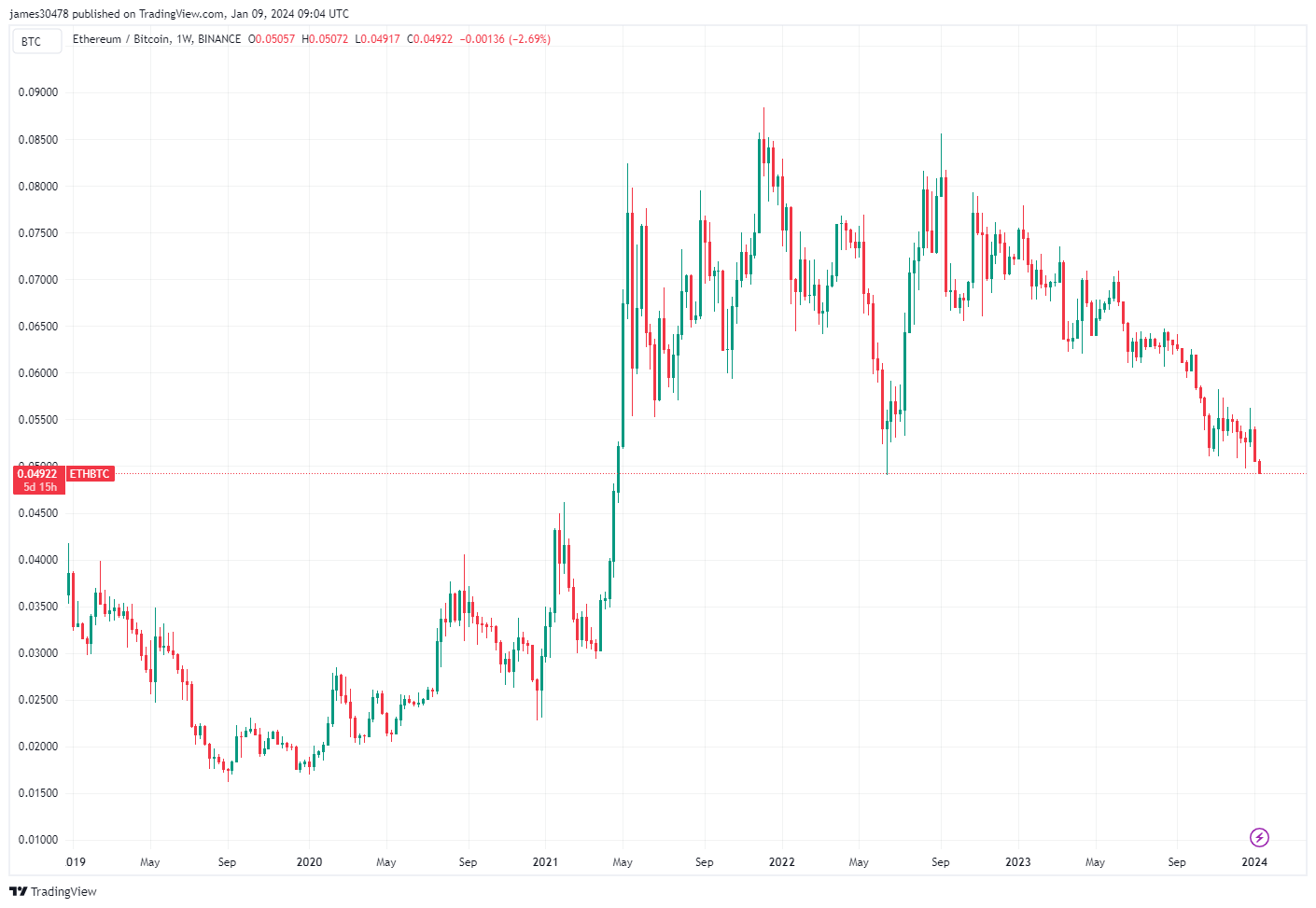

Furthermore, Ethereum’s performance against bitcoin (ETHBTC) declined, falling below 0.05 – marking a 36% decrease over the past year.

Additionally, within the last 24 hours, digital assets have experienced a substantial liquidation exceeding $200 million, with approximately $150 million originating from short contracts. Bitcoin bore the majority of these short liquidations, accounting for over $100 million in shorts, according to Coinglass.