Bitcoin accumulation hits new peak ahead of upcoming halving

Quick Take

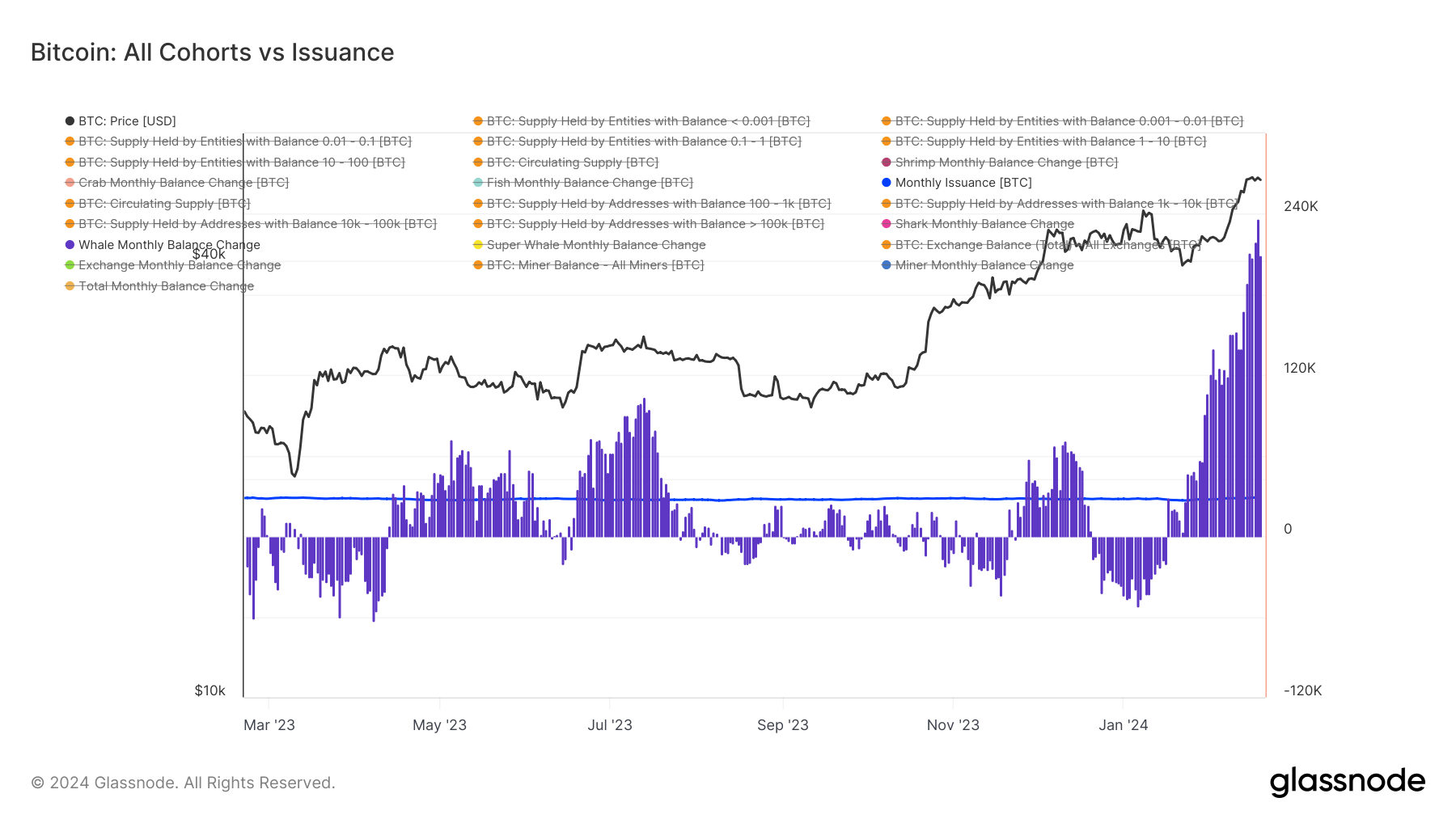

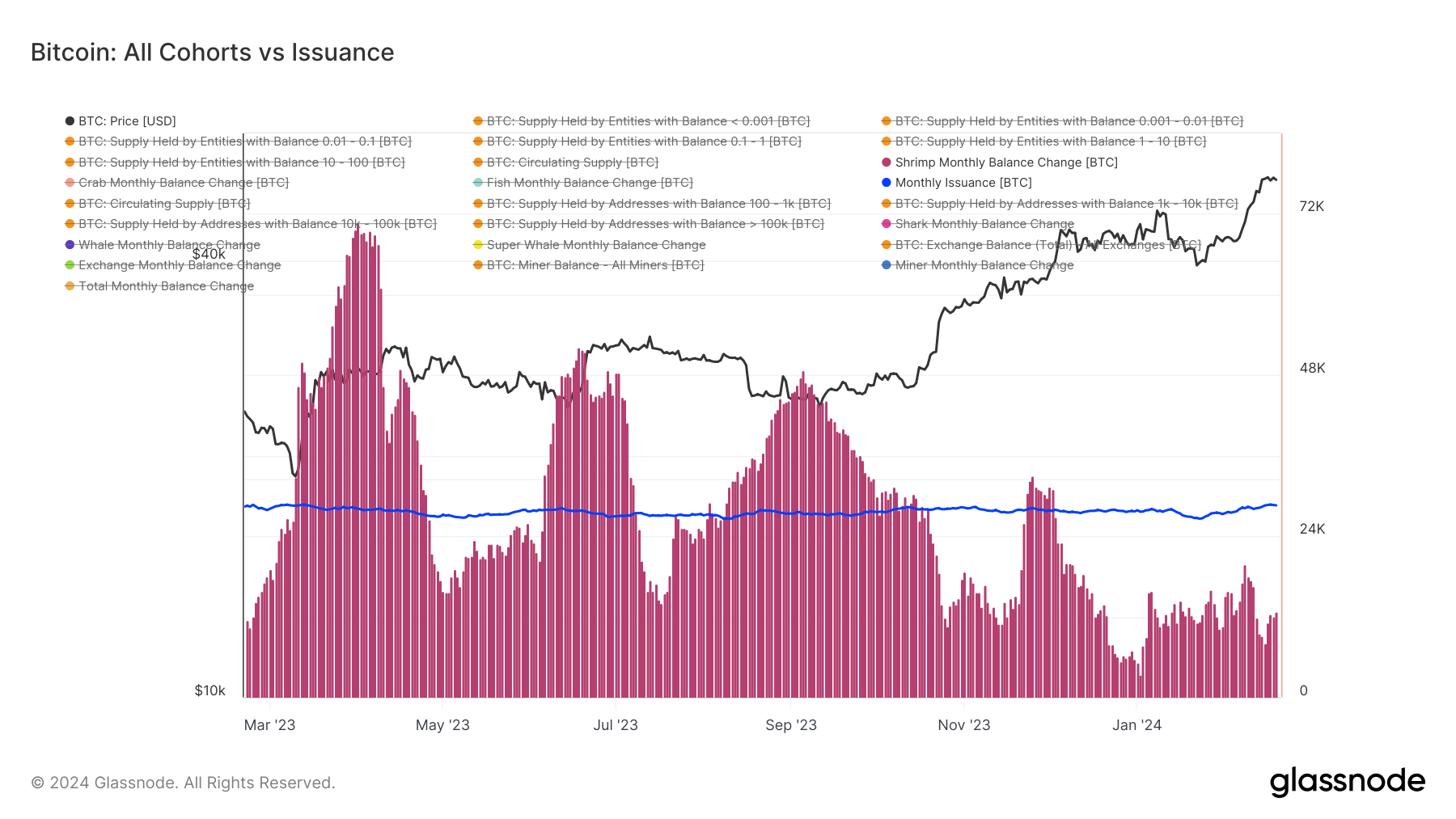

Over the course of the past 30 days, Bitcoin cohorts have shown remarkable accumulation, hitting a high last seen in October 2023 with a total monthly balance change of 111,000 BTC.

To put this into perspective, this is the highest Bitcoin accumulation witnessed since before the notable surge when Bitcoin’s value escalated from $25,000 to $40,000.

Currently, the monthly issuance of Bitcoin stands at 27,000, yet an anticipated halving event in April is to cut this issuance to 13,500 BTC per month. Interestingly, across all cohorts, Bitcoin accumulation is outpacing issuance by over four-fold.

Drilling deeper into specific cohort behavior, ‘Whales,’ those entities holding between 1k-10k Bitcoins, are accumulating approximately 236,000 BTC over a 30-day period, thereby leading the accumulation race. Meanwhile, ‘Super Whales,’ those holding 10k Bitcoin or more, have been observed distributing about 50k Bitcoin in the past month.

Simultaneously, exchanges have seen a net outflow of roughly 50k Bitcoin over the past 30 days. Among the smaller cohorts, ‘Shrimps,’ those holding less than 1 Bitcoin, have accumulated 13k Bitcoin, while ‘Crabs’ and ‘Fish’ have been noted for light distribution over the past 30 days.

Bitcoin ETFs, such as Grayscale, these entities typically distribute their holdings across a multitude of wallets. Furthermore, based on Glassnode’s parameters, entities with assets under management surpassing $51 million are now classified under the ‘Whale’ category.

Glassnode

Glassnode