Asia leads the way as Bitcoin price sentiment turns positive in all regions

Quick Take

The Bitcoin market has recently seen a noteworthy shift in sentiment, as its price climbed above $30,000. The fear and greed index now stands at a neutral value of 53.

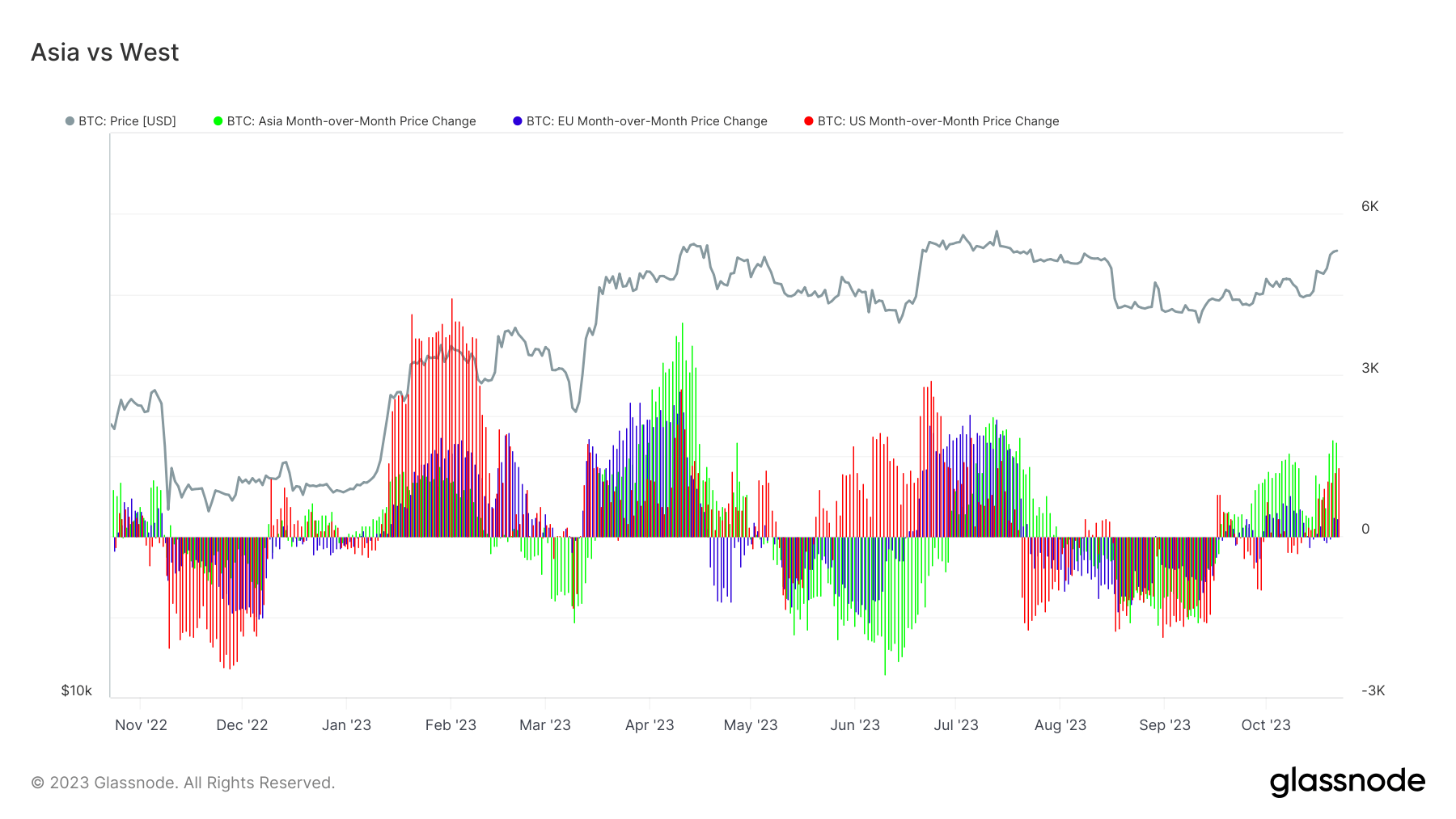

While all regions show bullish outlooks, the degree of bullishness varies. The 30-day price change during working hours – defined as 8am to 8pm Eastern Time for the U.S., 8am to 8pm Central European Time for the EU, and 8am to 8pm China Standard Time for Asia – provides an interesting perspective.

In this context, regional price variations are derived from a two-step process. Firstly, price fluctuations are allocated to regions based on their individual working hours. Then, regional prices are determined by calculating the cumulative total of these price deviations over time.

Interestingly, all three regions are experiencing accumulation and positive sentiment for the first time since July, with Asia leading.

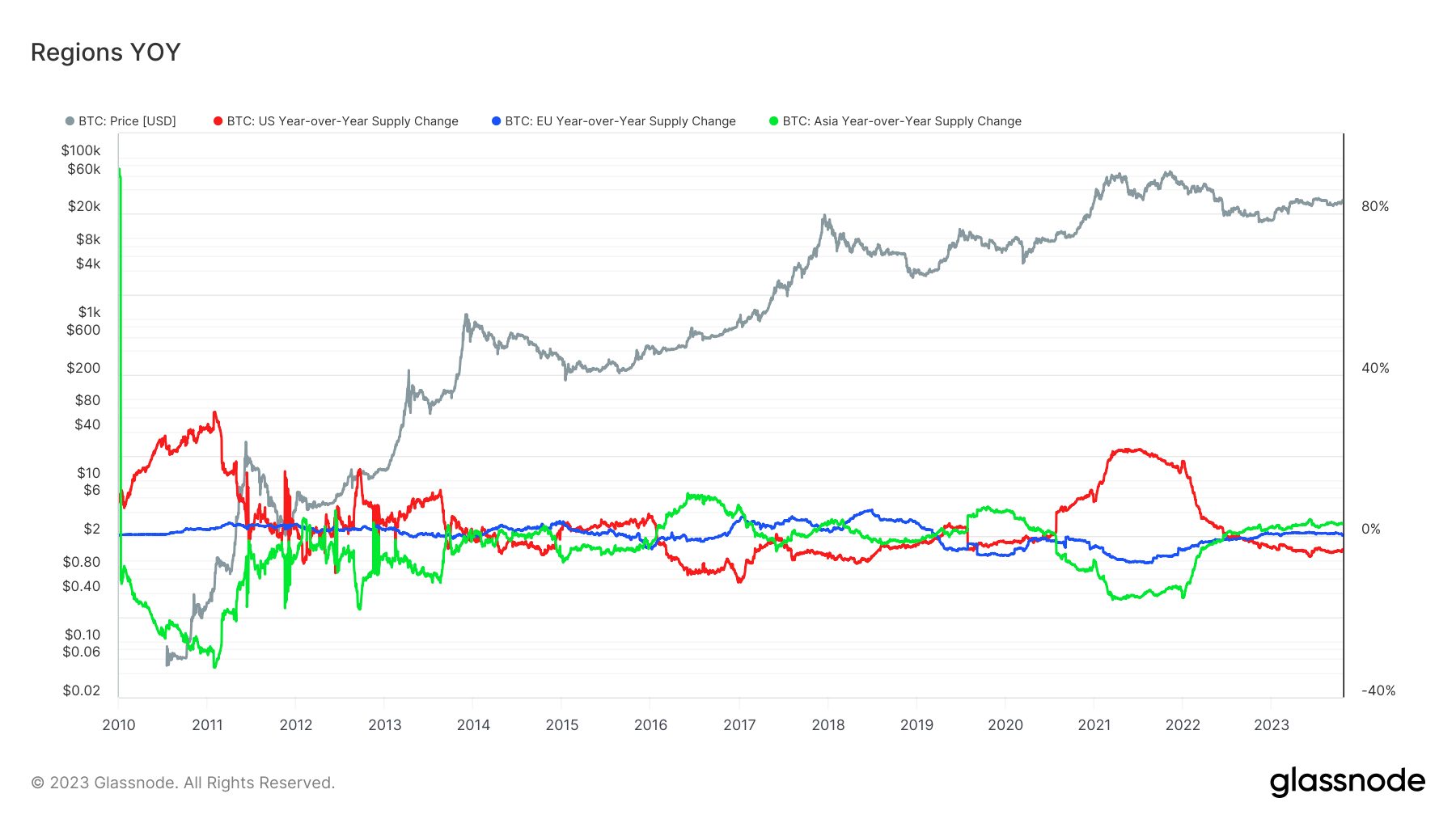

This leadership is further reinforced by Asia’s year-over-year supply change of over 3%, compared to the EU’s 0.2% and the U.S.’s -3.2%. This metric, established through probabilistic geolocation of Bitcoin supply at the entity level, affirms Asia’s strong market position and could potentially influence Bitcoin’s future trajectory.

Glassnode

Glassnode