Amid market turbulence, OKX and Bitstamp reflect Bitcoin’s volatile exchange climate

Quick Take

In the face of contemporary geopolitical instability and market unpredictability, Bitcoin exchanges are experiencing intense volatility in their inflows and outflows.

OKX Exchange, for instance, yesterday, Oct. 18, saw the largest Bitcoin inflow in almost three years, with approximately 8,000 Bitcoin valued at around $224 million.

Interestingly, this significant inflow is the largest since Nov. 2020, a period that also coincided with OKX’s largest outflow in the past three years. This simultaneous event of large inflows and outflows draws attention to Nov. 2020 as the inception of the previous cycle’s bull run.

Presently, OKX holds a year-to-date high of approximately 143,000 Bitcoin, the most since January 2021.

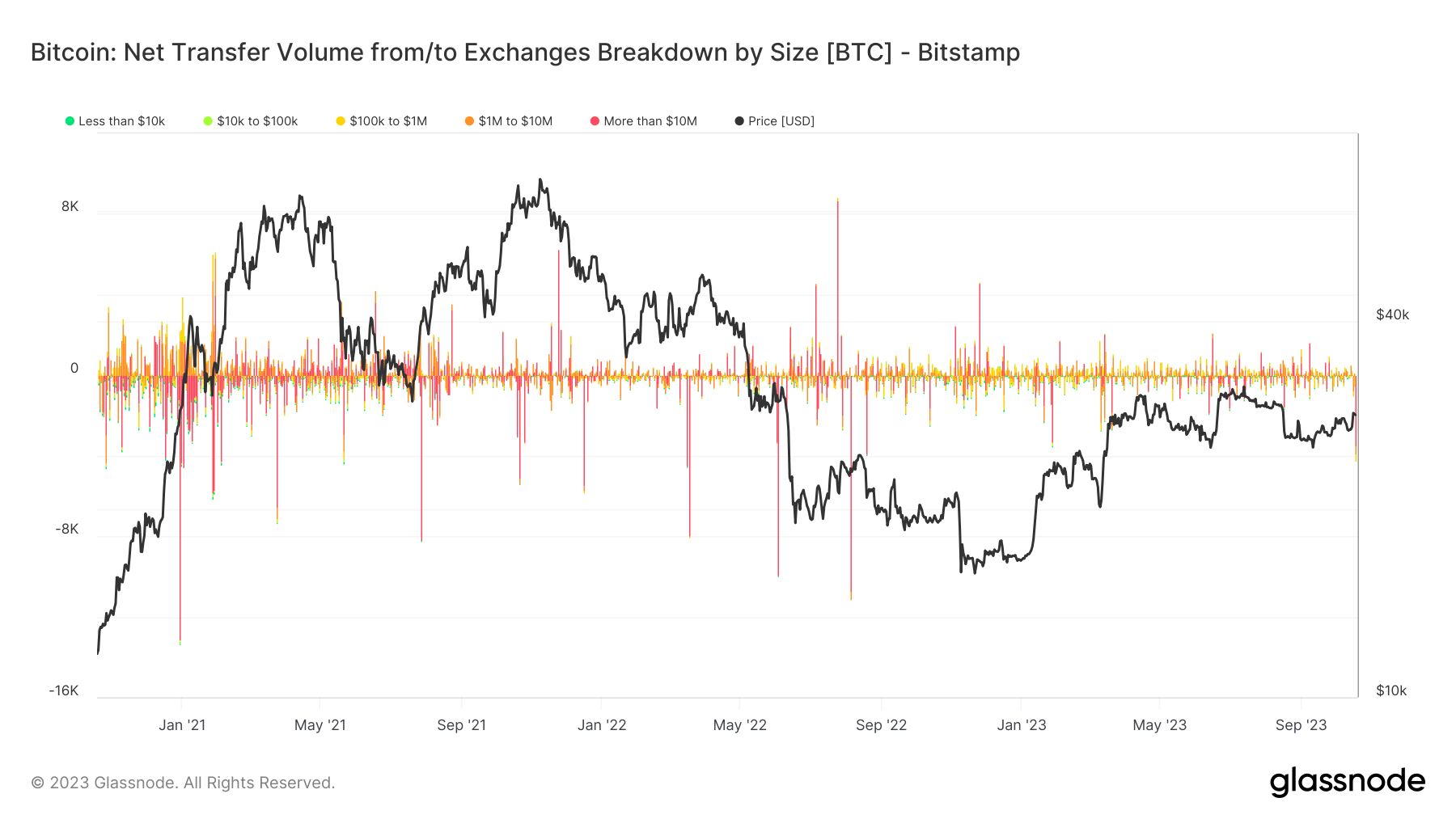

Conversely, Bitstamp Exchange has witnessed the largest outflow in over a year, with about 5,000 Bitcoins, equivalent to approximately $140 million. Currently, Bitstamp has about 40,000 Bitcoins on their platform, the lowest level since 2013.

These contrasting observations underscore not only the unpredictable nature of Bitcoin exchanges but also the divergent strategies of individual platforms amidst the ongoing market volatility.