$200 million in Bitcoin leaves exchanges amid ETF hearsay

Quick Take

Over the course of Oct. 16, a total of 7,000 Bitcoin, worth roughly $200 million, vacated exchanges. While some movement may be in response to a recent wave of misinformation regarding the approval of a Bitcoin spot ETF, the flurry of on-chain has persisted both before and after.

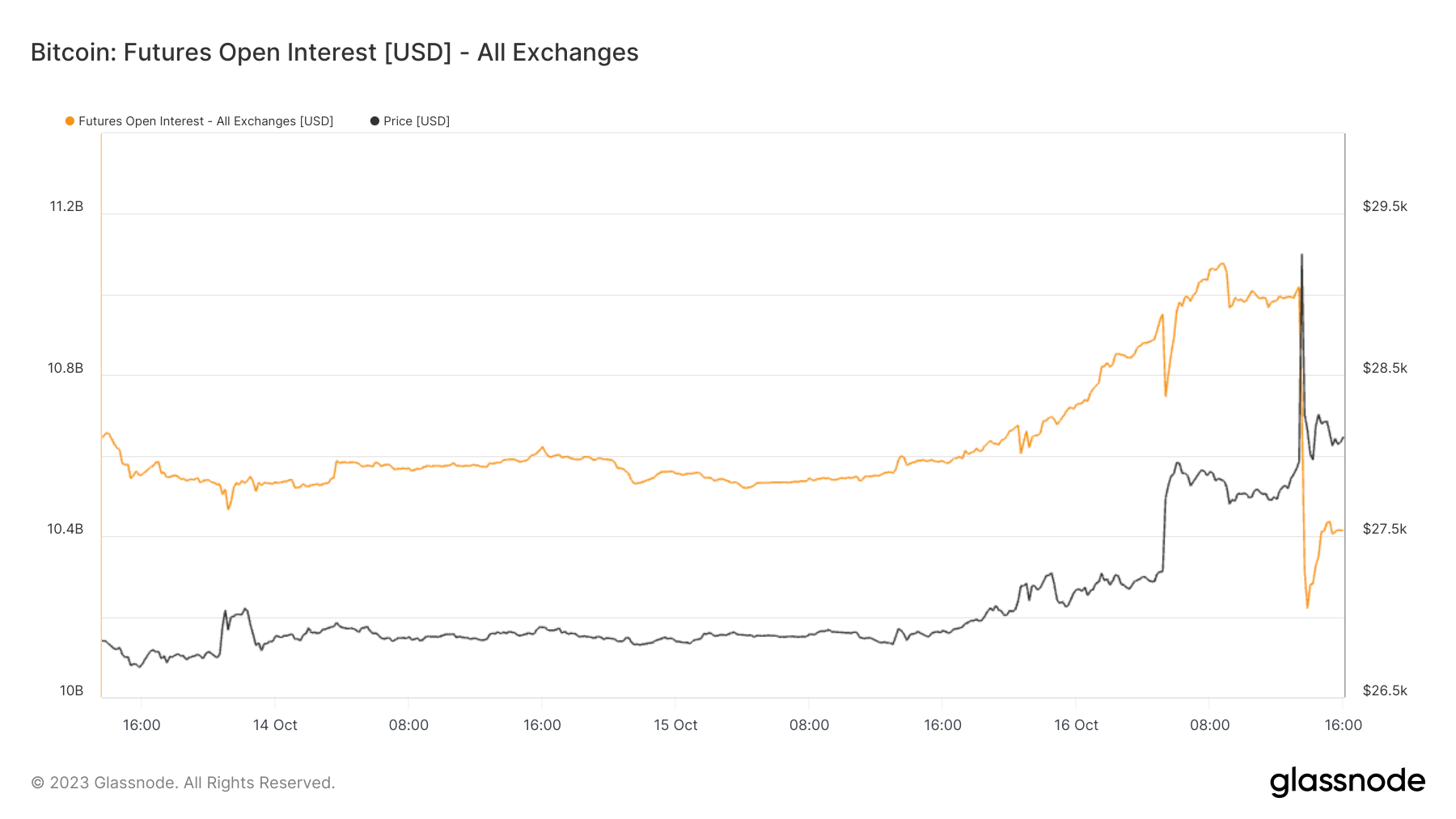

This movement was accompanied by a notable contraction in open interest, representing the total funds allocated in open futures contracts. Initially standing at $11 billion, open interest took a hit of over $1 billion, plunging to a little above $10 billion.

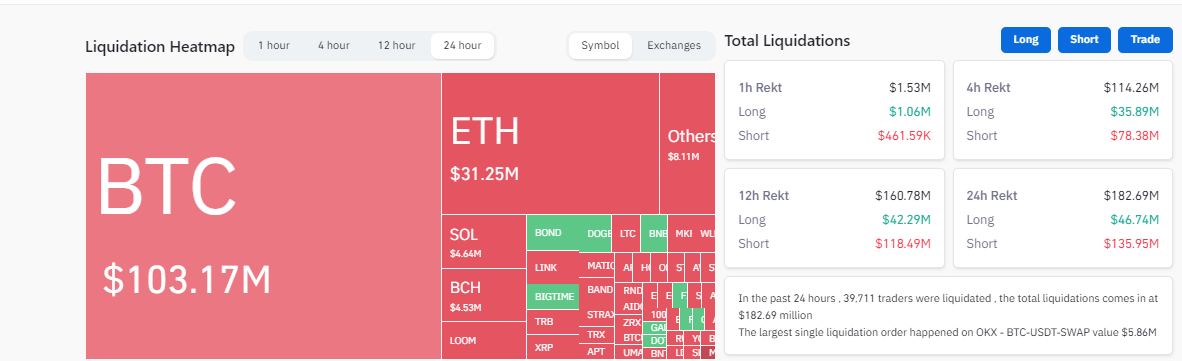

The ripple effects didn’t stop there. In the past 24 hours, there has been a liquidation of $183 million in the crypto market, with Bitcoin accounting for over $100 million of this total. More than $80 million of these Bitcoin liquidations were in the form of short liquidations, marking the largest such event since August 17.

Glassnode

Glassnode